- Analytics

- News and Tools

- Market News

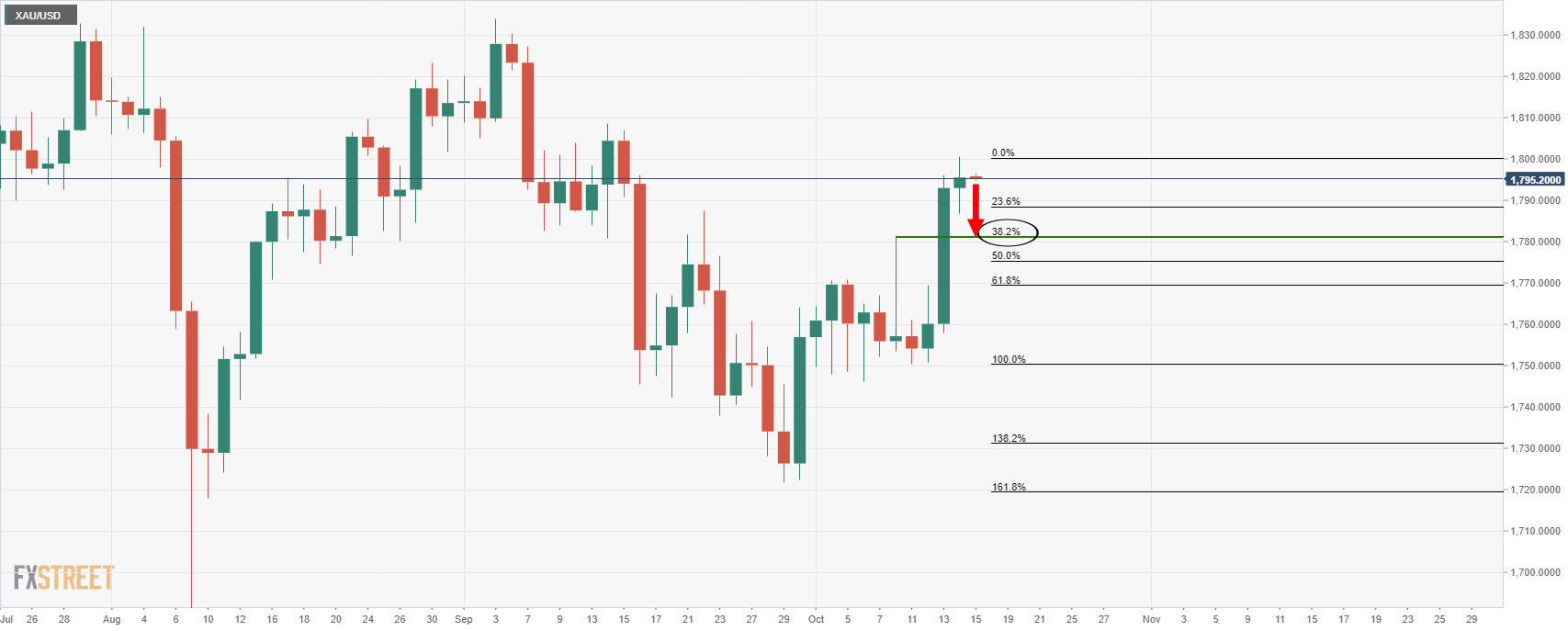

- Gold Price Analysis: Bulls move in on $1,800 as stagflation fears kick-in

Gold Price Analysis: Bulls move in on $1,800 as stagflation fears kick-in

- Gold reached $1,800 and could be firmer for longer.

- Markets are concerned about stagflation and gold is seen as a hedge against it.

The price of gold is flat in the Tokyo open on Friday, trading near $1,796 as the price consolidates its recent rally from out of consolidation near $1,750. The highs of the rally were $1,800 stored the prior European session.

The US dollar has been sinking of late as markets take profit in heavily long positioning that has been building ever since the markets had started to price in the Federal Reserve's hawkish turn and the prospects of not only tapering but higher interest rates next year.

However, the US dollar reversed course mid-week even after the minutes of the Fed's Sept. 21-22 policy meeting confirmed the intentions to start tapering of stimulus as soon as November. Inflation is regarded as being here to stay for longer at the Fed and that has raised concerns over stagflation for which gold is recognised as a hedge.

Gold, a hedge against stagflation

''The market's intense focus on pricing the Fed's exit has ignored rising stagflationary risks brewing on the horizon, with speculators offloading their length onto central banks and physical buyers,'' analysts at TD Securities said.

''In fact, while stagflation has captured share of mind, with the story-count of stagflation-themed news rising to unprecedented levels, it has yet to translate into additional gold demand. However, as the global energy crisis intensifies, reasons to own the yellow metal are also growing more compelling, particularly as a cold winter could send energy prices astronomically higher, potentially pricing-out industries and fueling price asymmetries in markets.''

Brent monthly chart

-637698547793844717.png)

''This translates into a fat right tail in gold prices, which informs our long $1850/2000 call spread in gold. Real rates are just starting to sink, reflecting these growing risks,'' the analysts at TD Securities said.

''Further, ongoing purchases from CTA trend followers may catalyze a change in tune from the speculative community which could result in sustained price strength.''

Gold technical analysis

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.