- Analytics

- News and Tools

- Market News

- Gold Price Analysis: XAU/USD eyes $1,820 as next target – Confluence Detector

Gold Price Analysis: XAU/USD eyes $1,820 as next target – Confluence Detector

- XAU/USD has hit $1,800, the highest in a month.

- The Confluence Detector is showing is that gold's next big upside target is $1,820.

- Gold is not a dream risk-off hedge, nor is Bitcoin [Video]

Falling yields have always been good for gold – and this time, the precious metal seems to have found its feet regardless of the Treausiries. Tuesday's slide in returns on 10-year bonds sent XAU/USD shooting higher, and it stayed there also after yields crept up once again.

One of the explanations for the recent rise is the hint from the Fed that the pace of bond-buying will be reduced only gradually – 15 billion fewer dollars worth of buys every month rather than $20 billion.

How is XAU/USD technically positioned?

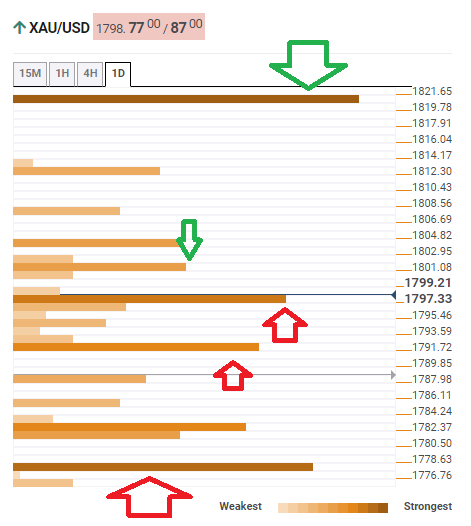

The Technical Confluences Detector is showing that gold faces some resistance at $1,802, which is the convergence of the 100-day Simple Moving Average, the Bollinger Band 15min-Upper, and the previous 4h-high.

The more significant line is $1,820, which is where the Pivot Point one-month Resistance 1 and the PP one-day R2 meet up.

Immediate support awaits at $1,797, which is the confluence of the 200-day SMA and the PP one-week Resistance 2.

The next line to watch is $1,791, which is a juncture of indicators including the Fibonacci 61.8% one-month and the SMA 100-15m.

Lower, strong support awaits at $1,777, which is where the PP one-week, the 50-day SMA, and the SMA 50-1h all converge.

XAU/USD resistance and support levels

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.