- Analytics

- News and Tools

- Market News

- US Dollar Index regains some composure and flirts with 94.00

US Dollar Index regains some composure and flirts with 94.00

- DXY bounces off lows and approaches the 94.00 barrier.

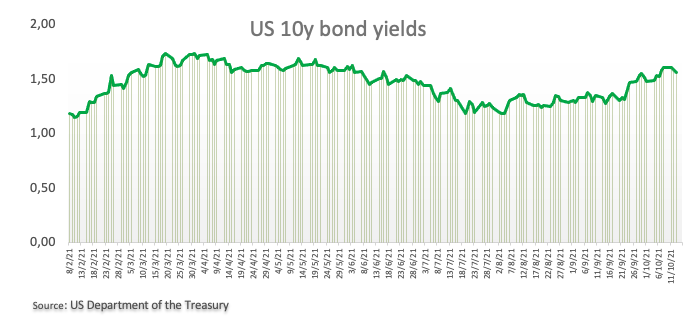

- US 10-year yields remain depressed around the 1.53% area.

- US weekly Claims rose by 293K, bettering consensus.

After bottoming out around 93.75 during early trade, the greenback has managed to attract some buying interest and now pushes the US Dollar Index (DXY) back to the 94.00 neighbourhood.

US Dollar Index looks supported near 93.70

The index dropped and rebounded from multi-day lows in the 93.80/75 band on Thursday, always trading on the defensive against the backdrop of the improved mood in the risk complex and declining US yields.

Indeed, yields in the belly of the curve retreated to the sub-1.53% region while the longer end managed to bounce to the 2.07% area and reverse part of the recent moderate retracement.

In the docket, weekly Claims rose less than expected by 293K in the week to October 8, while Producer Prices surprised to the downside in September: up 8.6% YoY and 6.8% when it comes to the Core reading.

In addition, St. Louis Fed J.Bullard said he bets 50% on chances of elevated inflation persisting. He also expressed doubts in that inflation will fully disappear over the next 6 months.

US Dollar Index relevant levels

Now, the index is losing 0.05% at 93.95 and a break above 94.56 (2021 high Oct.12) would open the door to 94.74 (monthly high Sep.25 2020) and then 94.76 (200-week SMA). On the flip side, the next down barrier emerges at 93.77 (20-day SMA) followed by 93.67 (monthly low Oct.4) and finally 92.98 (weekly low Sep.23).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.