- Analytics

- News and Tools

- Market News

- When are the UK data releases and how could they affect GBP/USD?

When are the UK data releases and how could they affect GBP/USD?

The UK Economic Data Overview

The UK docket has the August month GDP data publication this Wednesday alongside the releases of the Kingdom’s Trade Balance and Industrial Production, all of which will drop parallelly at 0630 GMT.

The United Kingdom GDP is expected to arrive at +0.5% MoM in August vs. July 0.1% reading. The Index of Services (3M/3M) for August is seen sharply lower at 1.2%.

Meanwhile, the manufacturing production, which makes up around 80% of total industrial production, is expected to stand at 0% MoM in August vs. 0% recorded in July. The total industrial production is expected to come in at +0.2% MoM in Aug as compared to the previous reading of +1.2%.

On an annualized basis, the industrial production for Aug is expected to have dropped to 3.0% versus 3.8% previous while the manufacturing output is seen steady at 6% in the reported month.

Separately, the UK goods trade balance will be reported at the same time and is expected to show a deficit of £12.00 billion in Aug vs. the £12.7 billion deficit reported in July.

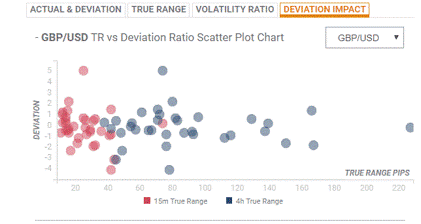

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements in excess of 60-70 pips.

How could affect GBP/USD?

At the press time, the GBP/USD is consolidating its bounce above 1.3600, as the US dollar retreats across the board. The cable remains divided between the hawkish BOE turn and rising Brexit concerns. All eyes remain on the critical UK and US macro releases due later this Wednesday.

Let’s take a look at the key technical levels for trading GBP/USD on the data releases. The pair faces immediate resistance at Tuesday’s high of 1.3638, above which the 1.3650 psychological barrier could be put to test. Further up, the two-week tops of 1.3675 will challenge the bearish commitments.

Alternatively, if the downside resumes, the GBP bears could target the 10-DMA at 1.3586. The next relevant support is seen at the multi-day troughs of 1.3569. The October 6 lows of 1.3543 could be the last line of defense for the cable optimists.

Key Notes

GBP/USD technical bearish trend continuation

US Consumer Price Index September Preview: Inflation averaging, what inflation averaging?

FOMC Minutes Preview: Fed to reiterate taper message, sending the dollar up, stocks down

About the UK Economic Data

The Gross Domestic Product released by the Office for National Statistics (ONS) is a measure of the total value of all goods and services produced by the UK. The GDP is considered as a broad measure of the UK economic activity. Generally speaking, a rising trend has a positive effect on the GBP, while a falling trend is seen as negative (or bearish).

The Manufacturing Production released by the Office for National Statistics (ONS) measures the manufacturing output. Manufacturing Production is significant as a short-term indicator of the strength of UK manufacturing activity that dominates a large part of total GDP. A high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or bearish).

The trade balance released by the Office for National Statistics (ONS) is a balance between exports and imports of goods. A positive value shows trade surplus, while a negative value shows trade deficit. It is an event that generates some volatility for the GBP.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.