- Analytics

- News and Tools

- Market News

- US Dollar Index reverses the downside, back around 94.20

US Dollar Index reverses the downside, back around 94.20

- DXY starts the week on a positive footing above 94.00.

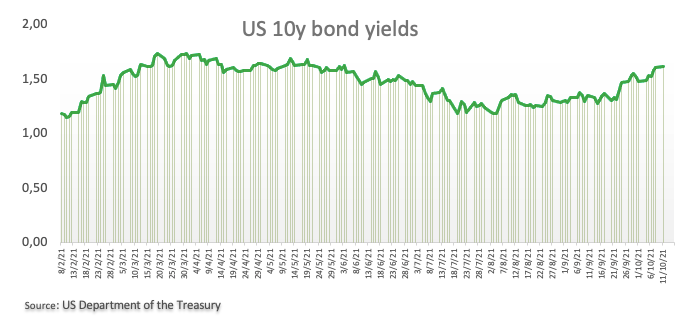

- US 10-year yields regain traction above the 1.60% mark.

- Short-term Auctions will be the sole release in the US docket.

The greenback, when tracked by the US Dollar Index (DXY), manages to reverse two sessions with losses and resumes the upside around the 94.20 area on Monday.

US Dollar Index up on higher yields

The index picks up further pace and re-visits the 94.20 region at the beginning of the week sustained by the positive momentum in US yields.

Indeed, yields of the key US 10-year benchmark note extend the rally and climb past the 1.61%. The short end of the curve, in the meantime, records new highs above 0.32% so far on Monday.

Indeed, the selloff in the fixed-income universe remains well in place for yet another session, while market participants continue to digest Friday’s disheartening Payrolls figures along with prospects of QE tapering as soon as in November.

Nothing scheduled data wise in the US docket other than a 3m, 6m Bill Auctions. Later in the week, the focus of attention is expected to gyrate around the publication of inflation figures tracked by the CPI for the month of September.

What to look for around USD

The index resumes the upside and keeps navigating in the upper end of the recent range north of 94.00 the figure on Monday. Positive news from the debt-ceiling front sponsors the selloff in the bonds market and propel yields higher, lending extra legs to the buck at the same time Looking beyond the immediate term, the dollar remains underpinned by markets’ adjustment to prospects for a “soon” start of the tapering process, probable rate hikes at some point during next year and the rising view that elevated inflation could last more than initially expected.

Key events in the US this week: Inflation tracked by the CPI, FOMC Minutes (Wednesday) – initial Claims (Thursday) – Retail Sales, flash Consumer Sentiment (Friday).

Eminent issues on the back boiler: Biden’s multi-billion Build Back Better plan. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. Debt ceiling debate. Geopolitical risks stemming from Afghanistan.

US Dollar Index relevant levels

Now, the index is gaining 0.16% at 94.26 and a break above 94.50 (2021 high Sep.30) would open the door to 94.74 (monthly high Sep.25 2020) and then 94.76 (200-week SMA). On the flip side, the next down barrier emerges at 93.67 (weekly low Oct.4) followed by 93.59 (20-day SMA) and finally 92.98 (weekly low Sep.23).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.