- Analytics

- News and Tools

- Market News

- CAD: Carry advantage to prevail - ING

CAD: Carry advantage to prevail - ING

Analysts at ING note the Canadian dollar has been facing the hurdles of grim data flows and subsequently increased bets on BoC easing.

"However, CAD is up 3% versus the dollar YTD, mostly thanks to the supportive rate environment in Canada. While we expect the BoC to deliver a cut in the next few months, we do not see this as ultimately denting CAD’s rate advantage.

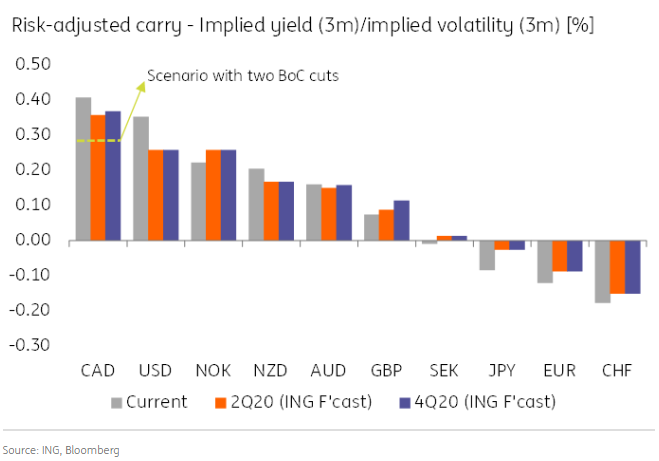

The figure above shows how – according to our forecasts – CAD is bound to retain the best risk-adjusted carry in the G10 space, even in a scenario with one or two BoC cuts. A stabilization in risk sentiment should allow, in our view, commodity currencies to outperform in 2020 and we expect CAD to lead the pack as it should be able to cash in on its attractive carry.

On the external side, our commodities team is looking at more OPEC+ cuts in 2020, which should put a floor under oil prices. The long-awaited ratification of the USMCA may also add to the relative positives for CAD. All these factors lead us to believe that USD/CAD will be able to move below 1.30 in the first half of 2020, despite the prospect of BoC easing. We see the pair at 1.25 in 4Q20."

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.