- Analytics

- News and Tools

- Market News

- Our EUR/USD parity forecast for end-Q1 is a little aggressive - BTMU

Our EUR/USD parity forecast for end-Q1 is a little aggressive - BTMU

"Adding to the political risks in France is of course the elections in the Netherlands and Germany. The outlook in relation to the German elections has changed somewhat following the emergence of Martin Schulz, who became the SPD candidate for Chancellor. The move has boosted the popularity of the SPD and raised the probability of the CDU/CDS not retaining power following the election in September. Greece has also added to the uncertainty although we do not expect problems in Greece to escalate like before. Discussions will continue and we expect an agreement to be reached before large repayments by Greece are due in July.

In these circumstances, the ECB is likely to remain very determined with its message to the financial markets that the monetary stance will be maintained. The data from the euro-zone continues to improve - the euro-zone Composite PMI jumped to 56.0 in preliminary data for February, consistent with Q/Q real GDP growth of 0.6% - but we doubt this will alter the rhetoric of the ECB any time soon. The annual core CPI rate remains stuck at 0.9% and upward momentum over a period of two to three months would be required before the ECB even considers altering its message. The political uncertainty will continue to provide additional incentive.

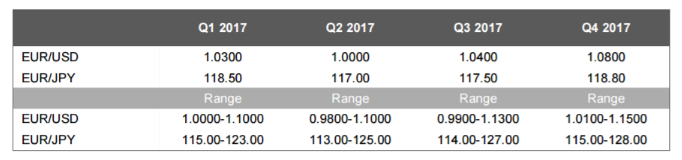

While EUR/USD moved lower in February, there is a degree of resilience that suggests our parity forecast for end-Q1 is a little aggressive. We therefore have adjusted our forecasts a little higher, but have maintained the same profile as before".

(Source: Bank of Tokyo Mitsubishi UFJ )

Copyright © 2017 BTMU, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.