- Analytics

- News and Tools

- Market News

- Wall Street. Major U.S. stock-indexes in positive area

Wall Street. Major U.S. stock-indexes in positive area

Major U.S. stock-indexes rallied on Wednesday, with the Dow hitting a record above 21000 points, while the dollar and U.S. Treasury yields jumped as investors bet that a U.S. interest rate hike would come soon. New York Fed President William Dudley - one of the most influential U.S. central bankers, and usually considered a dove - said late Tuesday that the case for tightening monetary policy had become "a lot more compelling", while San Francisco Fed President John Williams said he saw "no need to delay" raising rates.

Most of Dow stocks in positive area (21 of 30). Top loser - Intel Corporation (INTC, -1.33%). Top gainer - JPMorgan Chase & Co. (JPM, +3.20%).

Most of S&P sectors are also in positive area. Top loser - Utilities (-0.1%). Top gainer - Financials (+1.9%).

At the moment:

Dow 21108.00 +301.00 +1.45%

S&P 500 2395.50 +32.75 +1.39%

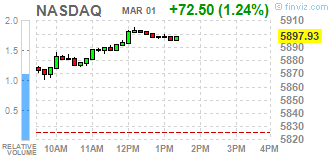

Nasdaq 100 5386.25 +54.00 +1.01%

Oil 53.90 -0.11 -0.20%

Gold 1248.40 -5.50 -0.44%

U.S. 10yr 2.46 +0.10

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.