- Analytics

- News and Tools

- Market News

- The pound’s upward momentum has been reinforced - BTMU

The pound’s upward momentum has been reinforced - BTMU

"The pound has continued to strengthen during the Asian trading session despite further dovish comments yesterday from BoE policymakers.

The pound's upward momentum has been reinforced after EUR/GBP closed below its' 200-day moving average at around 0.8470 for the first time yesterday since late in 2015.

It could provide an important bullish technical signal for the pound in the near-term, and supports our view that the pound will outperform more bearish expectations during the first half of this year and lower EUR/GBP closer to the 0.80000-level.

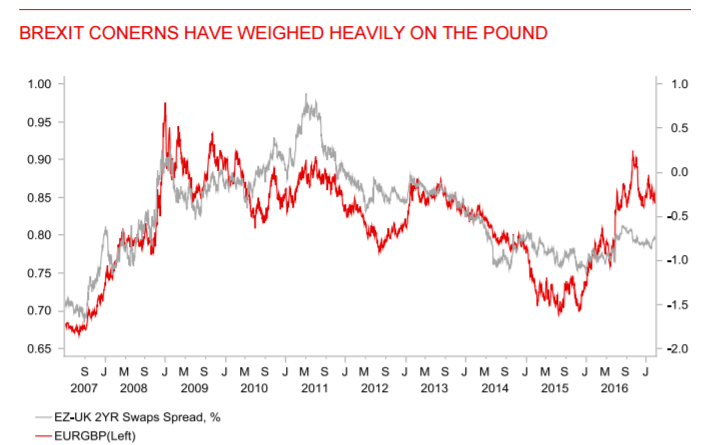

Building political risks in Europe are providing support for the pound and are beginning to outweigh Brexit concerns at least in the near-term.

We have never bought into the view that the triggering of Article 50 which is still likely next month should justify further pound weakness after it has already lost around a fifth of its value against the currencies of the UK's main trading partners in recent years.

We continue to believe that the bulk of the Brexit adjustment is already behind us with a lot of bad news and uncertainty already priced into the pound at current weak levels".

Copyright © 2017 BTMU, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.