- Analytics

- News and Tools

- Market News

- Deutsche Bank says ECB taper is not necessarily bullish for EUR

Deutsche Bank says ECB taper is not necessarily bullish for EUR

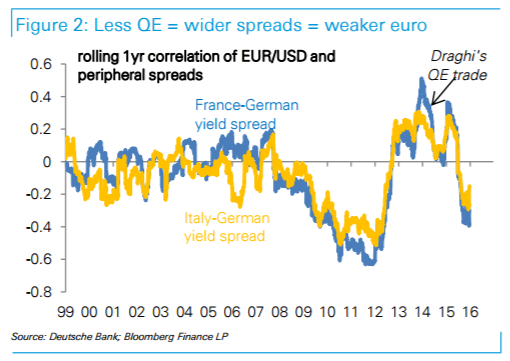

"One of the pushbacks we get to our weaker euro view is that the ECB will signal tapering this year preventing EUR/USD weakness. We don't agree.

First, tapering is not necessarily bullish for a currency. When the Fed signaled taper in mid-2013 the dollar strengthened a lot against EM but it weakened against both the euro and yen.

Second, ECB tightening is not that simple. Not only would it steepen curves but it risks a return of redenomination risk that has been conveniently compressed by the ECB's fight against deflation.

Finally, EUR/USD is not just about the ECB but also the Fed and the level of US yields...With the dollar having transitioned to a high-yielder and even more Fed hikes to come, the greenback should be doing a good job of attracting inflows and deflecting its use as a funding currency to both the euro and the yen.

The dollar has had a tough start to start the year but we are not giving up on our bullish view for 2017".

Copyright © 2017 DB, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.