- Analytics

- News and Tools

- Market News

- The yen fell after the publication of weaker-than-expected Japanese GDP data

The yen fell after the publication of weaker-than-expected Japanese GDP data

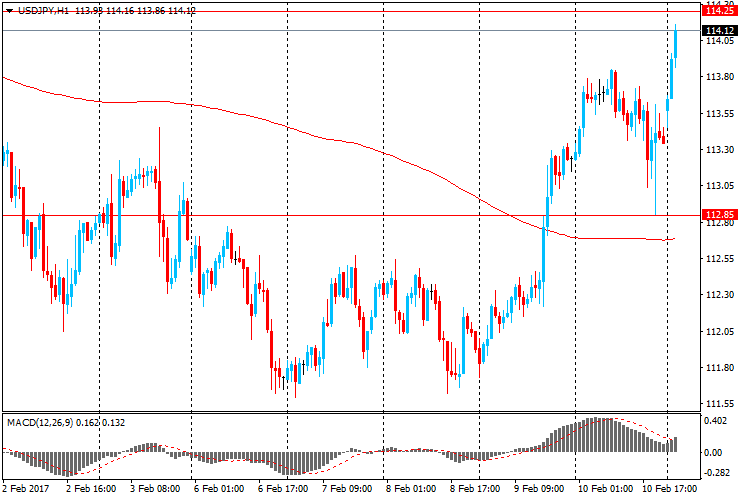

USD / JPY has risen more than 50 points, breaking the level of Y114.00, after Japan's GDP for the fourth quarter, which turned out to be weaker than expected.

According to the Cabinet of Ministers of Japan, Japan's GDP in the fourth quarter, seasonally adjusted, increased by 0.2%, lower than economists forecast and the previous value of 0.3%. On an annualized basis, Japan's economy grew by 1.0%, which is below the forecast of 1.1%. However, the value of the third quarter was revised from 1.3% to 1.4% GDP report expresses the total value of all final goods and services in monetary terms, made by Japan for a certain period of time. This is the main macroeconomic indicators of market activity because it assesses the growth or decline of the economy.

Nominal GDP increased by 0.3% after +0.2% prior. This was an increase for the fourth quarter in a row. The GDP deflator, indicating the rate of inflation, dropped by 0.1%, while analysts expected a decline of -0.2%.

Consumer spending in the fourth quarter remained flat after rising 0.3% in the third quarter, but business spending increased by 0.9% after declining 0.3% previously.

Exports expanded rapidly since the fourth quarter of 2014. The contribution of external demand to GDP was + 0.2%, domestic demand flat.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.