- Analytics

- News and Tools

- Market News

- President Trump and the dollar, according to Goldman Sachs. Bullish view unchanged

President Trump and the dollar, according to Goldman Sachs. Bullish view unchanged

"Markets are worrying over the "true" intentions of the new administration. Concern that President Trump is mercantilist and may talk down the Dollar has seen the Dollar fall notably below the 2-year rate differential, as markets have priced a protectionist risk premium.

Our last FX Views argued that this decoupling is unlikely to last, given that the correlation of the Dollar with front-end differentials is one of the more stable relationships out there.

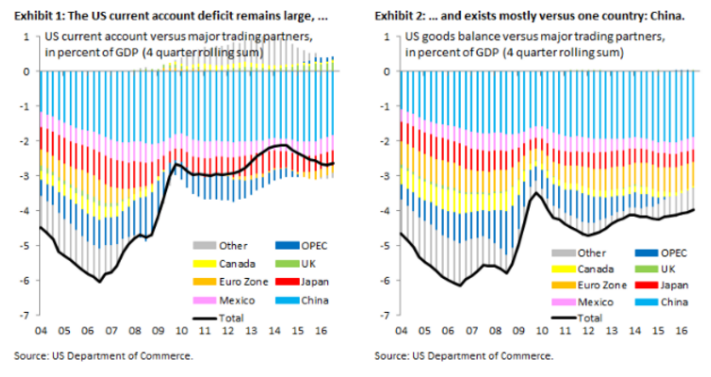

That said, today we examine the persistent and large US current account deficit, given that it is often cited as evidence that the Dollar is overvalued and needs to fall.

We argue that the current account deficit, which stands at 2.6 percent of GDP, is a flawed metric on which to make a valuation judgment for the broad Dollar. This is because the deficit is heavily skewed towards one country - China - which alone accounts for 1.8 percentage points, while Mexico, Japan and the Euro zone each play only supporting roles. The US current account deficit is therefore to a large degree a bilateral phenomenon vis-à-vis China, which also means that it bears implications not for the broad, trade-weighted Dollar but for $/CNY. We examine the implications that the bilateral current account has for the $/CNY exchange rate, concluding that - if the new administration wants to have a material impact on external trade - this is where its focus will ultimately have to be.

We remain firmly convicted RMB bears and, in the broader context, Dollar bulls".

Copyright © 2017 Goldman Sachs, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.