- Analytics

- News and Tools

- Market News

- BofA Merrill getting ready to long GBP into one final dip

BofA Merrill getting ready to long GBP into one final dip

"We believe that some of the traditional macro drivers for GBP, such as global growth and the UK housing and labour markets, are unlikely to be significantly impacted by the Brexit negotiations in the coming months. As a result, the divergences between these key drivers and GBP, which have built up as political risk premium has dominated price action, could be closed.

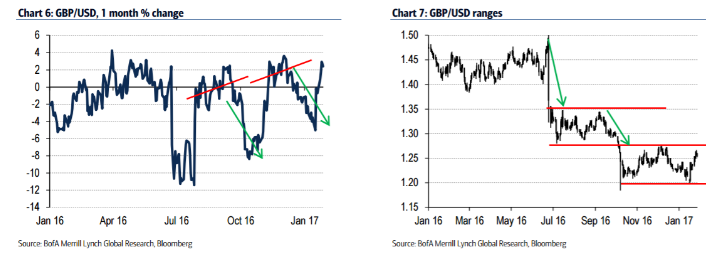

We expect one final dip in GBP as Article 50 (A50) is formally triggered and as the EU formally responds and sets out its negotiating position.

We think the crystallization of risks and the start of the countdown to Brexit may prove to be the low in GBP and the opportunity to enter GBP longs.

We reiterate our view that the formal triggering of Article 50 will mark the final phase of sterling's decline and mark the low point for GBP this year.

Our Q1/Q2 forecast for GBP/USD remains $1.15, although we concede that this target is being challenged. The scale of the GBP reaction will hinge on the EU's initial response to formal triggering. We are not optimistic on this front. We expect that the EU will inject a dose of reality regarding the challenges the UK will face in forthcoming negotiations. The EU will likely reiterate its red lines (the four fundamental freedoms) and the 2-year stopwatch thus becomes live. This scenario effectively challenges the growing view that the process toward divorce will not be a smooth one.

Medium-term fundamentals bullish GBP. Even though sterling has effectively decoupled from the UK growth cycle, in doing so, it is exposing the pound to upside risks if Brexit risks fade into the backdrop or as the markets become immune to the incessant news flow. In our view, with some of main pillars that have historically driven GBP through the business cycle remaining resilient to the Brexit shock, the upside risks to sterling are building. GBP looks cheap versus domestic metrics, such as the housing and labour markets.

We are therefore more optimistic on the mediumterm outlook for GBP, notwithstanding the near-term headwinds, which we think will push GBP back towards the bottom end of its trading range and further".

Copyright © 2017 BofAML, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.