- Analytics

- News and Tools

- Market News

- We do not expect fireworks from the upcoming FOMC meeting - Bank of America

We do not expect fireworks from the upcoming FOMC meeting - Bank of America

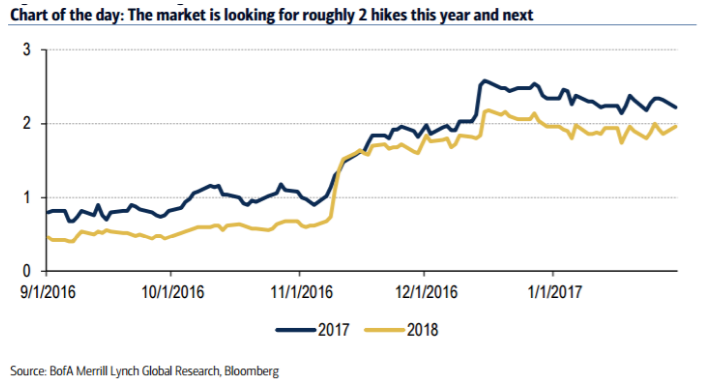

"We do not expect fireworks from the upcoming FOMC meeting. The Federal Reserve will be releasing its statement without a press conference or Summary of Economic Projections (SEP), which offers market participants less information to digest. We do not expect policy changes, with the FOMC holding rates at the 50-75bp range and maintaining the reinvestment policy. However, we do expect changes to the language. In particular, we think the Fed will highlight the reduction in labor market slack and perhaps note that confidence measures have improved. In our view, these changes would be perceived as a bit more hawkish. The market is pricing in just over two hikes this year and another two in 2018 (Chart of the day).

We similarly look for four hikes over this year and next, but believe the risk is for a faster cycle to start next year. If the communication sounds modestly more hawkish, we expect it to result in a further steepening of the near-term path of monetary policy and believe it could increase market-implied probabilities for a March hike.

FX: refocus on Fed could provide a reprieve for USD even with little expected.

The minor tweaks to language, as described above, could lend a slightly more optimistic tone, potentially suggesting some upside risks to FOMC pricing. While FX moves are likely to be limited, a more confident tone could provide some reprieve to the USD as the market refocuses attention on the balance of risks around Fed policy, which we continue see as skewed toward faster hikes on growth-positive fiscal stimulus.

With Inauguration Day out of the way, we continue to expect President Trump's fiscal and tax plans to support the USD, albeit in a choppier manner given the administration's greater penchant to talk it down.

Additionally, the decline in real rates that has taken the dollar with it recently, should be short-lived (Liquid Insight: The Trump trade divergence), particularly if the Fed turns increasingly hawkish amid rising inflation and further declines in the unemployment rate.

We continue to see USD/JPY as the best expression of these themes, and reiterated that view by opening a tactical long USD/JPY spot trade last week".

Copyright © 2017 BofAML, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.