- Analytics

- News and Tools

- Market News

- Goldman: in our view, Sterling is ‘actionable’ and soon set to become even more ‘unfashionable’

Goldman: in our view, Sterling is ‘actionable’ and soon set to become even more ‘unfashionable’

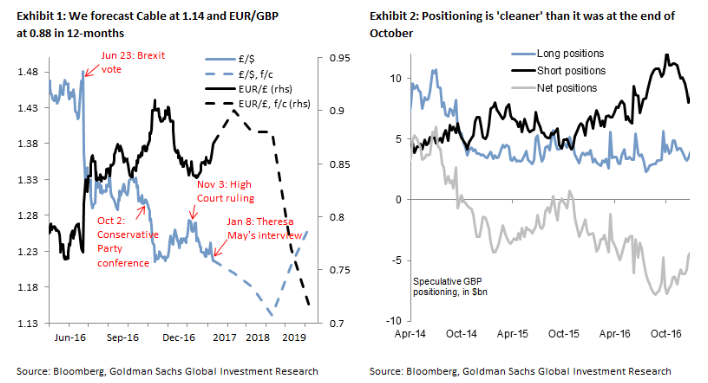

"The UK's High Court decision on November 3 took some pressure off the British Pound. But Prime Minister May's speech on Sunday (8 Jan), which simply restated her plan to trigger Article 50 by March and leave the EU within two years, has been sufficient to pull the currency down to the October lows.

Cable moved from 1.229 on Friday's close to 1.216 today. This is a testament to how vulnerable the Pound is to the repricing of a 'hard Brexit' scenario, as well as, in our view, the extent to which periods of Sterling strength are the result of markets not discounting the new reality appropriately, a reality that we have fully incorporated into our outlook for the currency since the referendum in June and that we have reiterated several times since.

The FX market has not yet re-engaged with selling Sterling. Net shorts have been reduced (Exhibit 2) and GBP has been one of the few G10 currencies not to depreciate substantially against the Dollar since the US elections.

But, in our view, Sterling is 'actionable' and soon set to become even more 'unfashionable', despite the recent move lower, as coming political events will only increase uncertainty on the future relationship between the UK and the EU. The Supreme Court is due to rule in favour of the High Court Decision on the need for a Parliamentary vote to trigger Article 50 by the end of the month. In response, the government will need to prepare a bill for the vote to take place before the end of March. This preparatory work, together with a subsequent parliamentary vote in favour of triggering Article 50, is likely to increase uncertainty even further. The kind of deal the EU and the UK will agree on will remain unclear for some time, with the UK government sticking to PM May's 'red lines' (immigration control and backing away from the European Court of Justice's jurisdiction) and the EU refusing to grant the UK participation in the Single Market under these demands. We expect the main economic consequences to be twofold: (i) an economic slowdown owing to elevated political uncertainty that reduces investment, employment and consumption as a result of higher prices, and (ii) an adjustment to the UK's external balance requiring a substantial decline in the current account deficit".

Copyright © 2017 Goldman Sachs, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.