- Analytics

- News and Tools

- Market News

- EUR - Cheap but unbuyable yet, JPY too fast to sell - Societe Generale

EUR - Cheap but unbuyable yet, JPY too fast to sell - Societe Generale

"A look forwards. The yen's nearly fallen too far/too fast to sell, the dollar's getting closer to its peak and the Euro is cheap but unbuyable before the French elections.

My favourite currencies are Scandinavian, and after an unstellar 2016, long SEK/KRW is a trade we've been pushing for a week or two. A more mundane G10 version is short EUR/SEK. A second trade is to be short NZD/NOK. Long current account surplus, short deficit. Finally, with all this positive growth, oil isn't done yet. Short GBP/CAD for a final flurry..

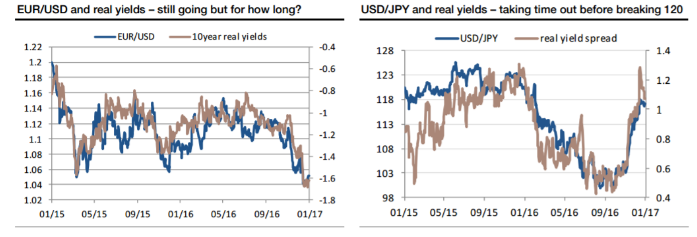

There is no Eurodollar recommendation on the list, though we do expect to see parity before the French presidential elections. In nominal terms, the Treasury/Bund yields spread, at around 225bp, is wider than any any point since April 1989, the time of the Hillsborough disaster and just over 6 months before the Berlin wall came down. More recently, we've seen a 100bp widening in the real yield differential between Germany and the US since the start of 2015, which has taken EUR/USD down by 15 figures. Another 30bp real yield widening isn't impossible but this morning's release of the strongest Eurozone manufacturing PMI since 2011 is surely a reminder that a softer currency and stronger US data aren't really compatible with never-ending doom pessimism about the European economic outlook. Getting EUR/USD down is like pushing Sisyphus' rock uphill.

USD/JPY doesn't look like an exciting buy on real yield differentials now, but they should be supportive again going forwards. Tread carefully, yen bears!"

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.