- Analytics

- News and Tools

- Market News

- Danske says EUR/USD set to bottom around 1.02 in 1-Month

Danske says EUR/USD set to bottom around 1.02 in 1-Month

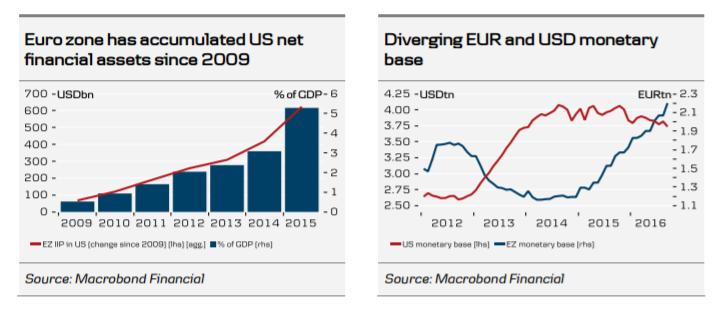

"Short term (1-3M horizon): In the short term, on the one hand there will be downward pressure on the US monetary base from the higher federal funds target and from the impact of new banking regulation with US banks set to be required to have an LCR of 100% by 1 January 2017. On the other hand, deposits on the US treasury account may fall at the beginning of next year after a resuspension of the debt ceiling, which will tend to increase the monetary base. Overall, this is likely to be marginally positive for USD and weigh on USD FX forward points vis- à-vis EUR and the Scandinavian currencies on top of the impact of the repricing of the path of Federal Reserve rate hikes, e.g. keeping the 3M EUR/USD basis spread around the present 70-80bp, and thus maintaining a significant negative carry on short USD positions. We look for EUR/USD to bottom at 1.02 in 1M.

Medium-term (6-12M horizon): Implementation of new regulation will continue in 2017, which is likely to continue to put downward pressure on the US monetary base. Additional rate hikes from the Federal Reserve in 2017 (we forecast a 25bp hike in June and December) are likely to be less of a strain on the monetary base than before and after the rate hike in December 2015, as the hiking cycle seems better aligned now with a recovery in the natural rate of interest. If the Federal Reserve attempts to push rates higher at a faster pace, it may become an issue though. This will maintain a higher negative carry on short USD positions vis-à-vis EUR and Scandinavian currencies than can be explained by the spread in interest rates, e.g. the 3M EUR/USD basis spread should stay around the present 70-80bp. Over the medium term, we look for the USD to fall back on valuation and the beginning of a correction of the large US current account deficit. As implementation of new regulation moves closer to the end, it should furthermore be less of a supportive factor for the USD. We forecast that EUR/USD will rise to 1.12 on 12M".

Copyright © 2016 Danske, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.