- Analytics

- News and Tools

- Market News

- BNP expects USD to gain broadly in 2017

BNP expects USD to gain broadly in 2017

"We think FX market price action in Q4 2016 will prove to be a reliable template for much of the year ahead, with the USD expected to gain broadly.

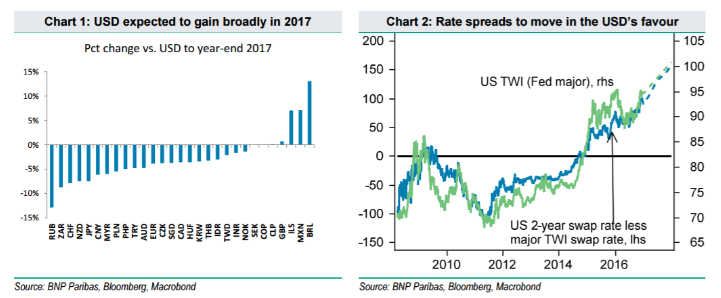

Our forecasts, as illustrated in Chart 1, call for the USD to gain ground vs most major and EM currencies, with the BRL and MXN representing notable exceptions.

We expect EURUSD to reach parity by year-end 2017, and we are even more ambitious for USDJPY, which we target at 128.

we remain positioned for USD gains via derivatives in USDJPY (targeting 128 by the end of 2017) and USDCAD (targeting 1.36 by the end of Q1 2017

Our forecasts imply that the Fed's broad tradeweighted USD index will appreciate by about 3% in 2017, topping its 2002 peak, and the major currency index will gain about 4%, falling short of its best levels in 2002. As has been the case for most of the past five years, the case for USD appreciation vs. G10 currencies is based on expectations for policy divergence. However, while policy divergence during 2011-16 was mainly driven by policy easing outside of the US, the next phase of USD gains is likely to be driven by Fed rate hikes. Our economists forecast above-trend growth averaging 2.4% in the US in 2017, spurred by fiscally stimulative tax reform and infrastructure spending programs we expect to be passed in the second half of the year.

With the US labour market operating close to full capacity and growth running above trend, we expect wage pressures to rise in 2017 and CPI to accelerate to a 2.2% y/y pace. Against this backdrop, we expect the Fed to deliver two rate hikes in the second half of 2017 and markets will likely price for rate hikes to continue through 2018. Consistent with this, we expect the two-year Treasury yield to reach 1.9% by the end of 2017, up from the current 1.28%. And, with other G10 central banks on hold or even easing further, front-end rate differentials should move substantially further in the USD's favour".

Copyright © 2016 BNP Paribas™, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.