- Analytics

- News and Tools

- Market News

- BofA Merrill post FOMC views on the dollar

BofA Merrill post FOMC views on the dollar

"From 2 to 3 hikes in 2017

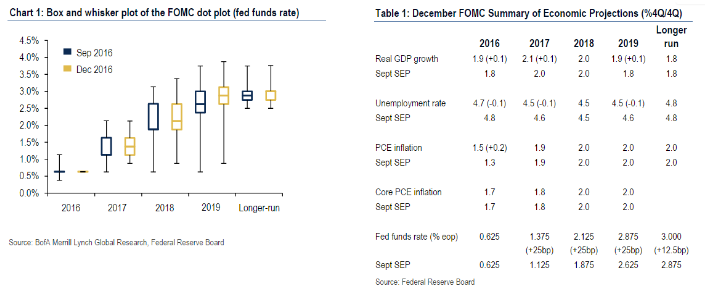

The FOMC hiked 25bp to a range of 50 - 75bp, as largely expected. The spotlight was on the dots, which shifted higher -the median forecast for 2017 fed funds increased to 1.375%, which implies three hikes for 2017. The trajectory stayed the same thereafter, assuming three hikes in 2018 and 2019, leaving the median forecast for the FF rate at 2.125% and 2.875%, respectively, for 2018 and 2019 ) The Fed also increased the long-run expectation for the fed funds rate to 3.0%. Outside of the dots, the economic forecasts were little changed with slightly stronger growth and a slightly lower unemployment rate, which was largely a mark-to-market. The statement maintained a cautious tone, noting that the Fed will continue to monitor risks. We are holding with our forecast that the Fed will hike once in 2017 and three times in 2018, but the risks to our forecast are skewed to the upside.

FX: Fed supports our bullish USD views

The FOMC statement confirms our view that the risks of a faster pace of Fed hikes on the back of fiscal easing will be a significant USD support in 2017. The increase in the Fed's dot plots to imply 3 hikes in 2017, while not directly attributable to fiscal easing, belies the upside growth risks from such policies. Indeed, as discussed above, oureconomics team now sees 2 hikes in 2017 (1 before) consistent with these risks.

Additionally, as we anticipated, the Statement and Chair Yellen did not evince any specific concerns about the recent USD rally. When asked in the press conference about the USD strength, Chair Yellen discussed broad asset price movements in terms of expectations for fiscal policy expansion. With trade-weighted USD gains since the election still relatively modest, and the Y/Y changes in the dollar flat, the USD is not the clear and present danger it was in the past 1.5 years. Also, the factors driving the Fed (namely Fed hikes and best US growth expectations) are what's driving the USD, not ECB/BOJ easing, so they are more able to withstand the tightening of financial conditions as a result. This leaves further room for the dollar to rise in the absence of a negative hit to growth & equity prices and/or a more permanent shift by the new administration away from the Treasury's long-held 'strong dollar' policy.

Bottom line, the trajectory of Fed policy will remain a positive USD support heading into 2017. We do see some risk that stretched fast money positioning (and other idiosyncratic factors) could lead to some periodic USD pullbacks, but the trend remains firmly higher following today's meeting".

Copyright © 2016 BofAML, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.