- Analytics

- News and Tools

- Market News

- Barclays is selling the facts at today’s FOMC

Barclays is selling the facts at today’s FOMC

"Wednesday's FOMC meeting is unlikely to provide a catalyst for further USD strength and may instead encourage profit taking on long USD positions as we approach year-end, particularly in currency pairs where the USD is most expensive.

A 25bp hike is widely expected by both interest rate markets (23bp of hikes priced) and analysts, including ourselves. Furthermore, fed funds futures imply a policy path for the coming year that is broadly consistent with the median FOMC participant September forecast (implied year-end 2017 fed funds rate of 0.96% versus median FOMC forecast of 1.1%). In its forward guidance, we expect Chair Yellen to balance the decision to raise rates with a dovish message of a shallow expected policy path and a willingness to test the potential benefits of running a "high pressure" economy.

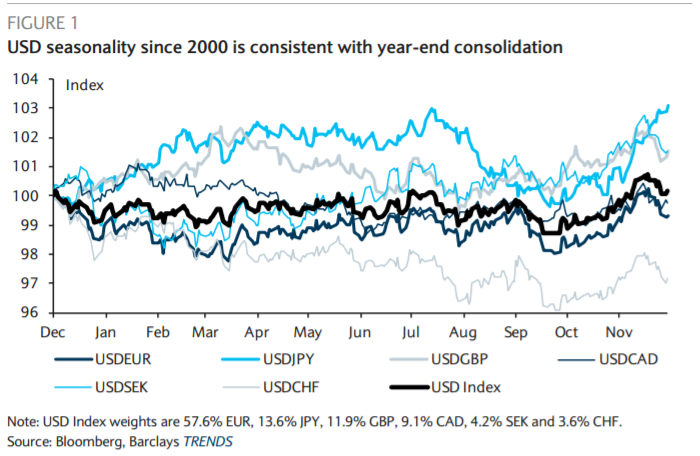

Positioning, valuation and seasonal factors also support some near-term USD consolidation. Our FX flow data are consistent with indications from FX futures markets, which suggest that speculative investors remain significantly long the USD. With USD appreciation of about 4% since early October on a trade-weighted basis, to a point where we estimate the USD is close to 20% expensive, we think there is strong incentive for these investors to unwind some of their positions as year-end approaches.

Seasonal considerations also suggest the USD, on an index basis, tends to weaken into year-end".

Copyright © 2016 Barclays Capital, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.