- Analytics

- News and Tools

- Market News

- TD is buying USD/CAD dips below 1.31 on stretched valuation

TD is buying USD/CAD dips below 1.31 on stretched valuation

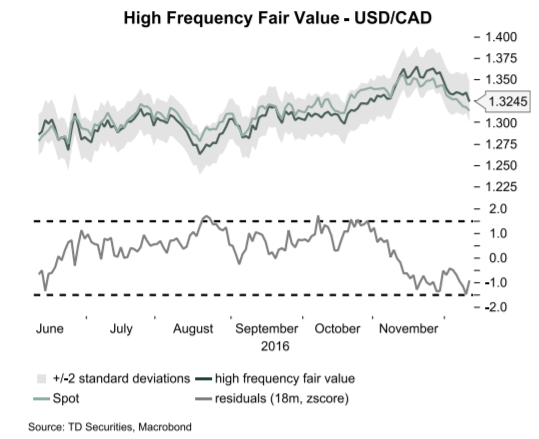

"The songs remains the same for CAD: short covering rally buffeted diverging policy rates. The short squeeze is strongly rooted in the recovery in oil prices following a string of positive news headlines about production cuts. Many have wondered why USDCAD has lagged oil prices but we note that correlation between USDCAD and oil has recently broken down. For instance, oil price levels have only explained about 10% of the variance in USDCAD over the past 3m and close to zero over the past six months. This compares to about 50% over the past year but that number drops to around 35% when you look at the percentage return in USDCAD and oil.

Even so, we believe that the importance of rate differentials and relative output gaps explains the breakdown in oil. Indeed, the BoC still sees about 1.5% worth of slack in the economy while most measures argue that the US economy is close to full capacity. Normally, both countries cycles move is lock-step. However, a mix of cyclical and structural factors have gnawed away at that relationship. This leaves us focused on rate differentials rather than oil and look for the widening rate spreads to continue to drive the pair higher.

We look to buy into dips below 1.31 based on stretched valuation".

Copyright © 2016 TD Securities, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.