- Analytics

- News and Tools

- Market News

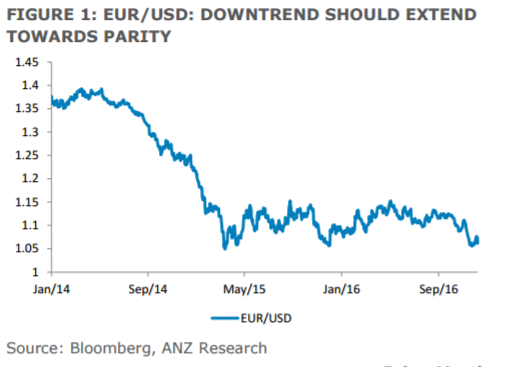

- Stay short EUR/USD and sell rallies after ECB says ANZ

Stay short EUR/USD and sell rallies after ECB says ANZ

"The ECB delivered a bazooka. It extended QE (by €540bn), allowed the purchase of bonds with a minimum one year maturity and the purchase of bonds with yields below the deposit rate (-40bps).

The euro fell and the forthcoming political cycle suggests portfolio outflows from the euro area will continue. Further EUR underperformance vs. USD, AUD, NZD and Asia is expected.

Our forecasts assume that EUR/USD will move towards parity in coming months. If anything, the December ECB policy meeting reinforces that view. And whilst the ECB has mapped out its policy landscape for 2017, there are still material event risks facing the euro area. The elections in the Netherlands in March, elections in France -presidential election in April/May and Assembly election in June - and general election in Germany in September take place against a backdrop of rising support for populist parties. An election in Italy can't be completely discounted either. There is also the issue of bad debts in the banking system, in particular Italy, which needs to be addressed.

Against a backdrop where the FOMC will be raising interest rates we advise staying short EUR/USD and selling rallies".

Copyright © 2016 ANZ, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.