- Analytics

- News and Tools

- Market News

- EUR/USD ahead of NFP and Italian Referendum - Barclays

EUR/USD ahead of NFP and Italian Referendum - Barclays

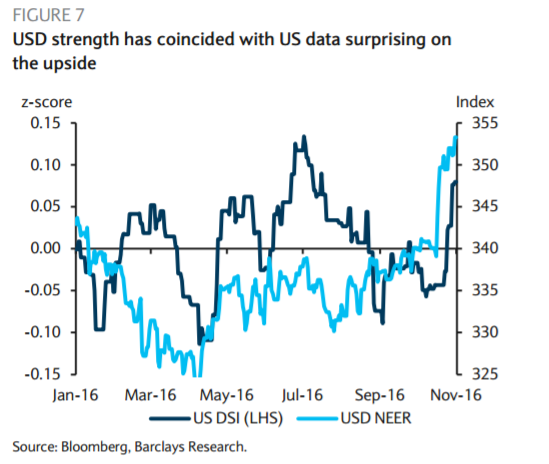

"We see asymmetric risks to the USD this week as the employment report (Friday) takes central stage. A number close to our expectation of 175k or even lower would keep the Fed on track as it is assumed that a deceleration in job creation is normal as the labour market is near full employment. On the other hand, a higher number (closer to 200k) would signal that the momentum is still strong, and that additional stimulus would probably lead the Fed to act faster, accelerating USD trend. We expect the unemployment rate to decline to 4.8% from 4.9%, average hourly earnings to rise 0.2% m/m and 2.8% y/y, and the average workweek to remain unchanged at 34.4 hours.

In addition, we expect the ISM manufacturing (Thursday) to remain soft and decreasing slightly from 51.9 to 51.5 as employment in the manufacturing sector remained weak through October.

Next Sunday's Italian referendum on Senate reform is an important event for markets this week but a "no" outcome appears largely priced in EURUSD, in our view. Polls suggest that most voters oppose PM Renzi's proposal and should that be realised, we expect him to step down. While recent EURUSD depreciation has largely been driven by USD strength, we think a portion of recent EUR weakness reflects a discount to various political risks over the coming year, including elections in the Netherlands, France and Germany. Given these residual risks we think any sustained EURUSD appreciation is unlikely. The reaction to a surprise "yes" vote is uncertain with, bi-modal implications: it simultaneously increases the likelihood of Prime Minister Renzi's reform agenda (if the PD, Mr. Renzi's party, wins the next election) and the likelihood of radical change and rejection of the euro if 5SM wins.

On the data front, November euro area headline/core inflation (Wednesday) is expected to remain unchanged at 0.5%/0.8%, while euro area final November manufacturing PMI (Thursday) is expected to be confirmed at 53.7".

Copyright © 2016 Barclays Capital, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.