- Analytics

- News and Tools

- Market News

- Rate differentials rather than Oil correlation support the dollar - Goldman Sachs

Rate differentials rather than Oil correlation support the dollar - Goldman Sachs

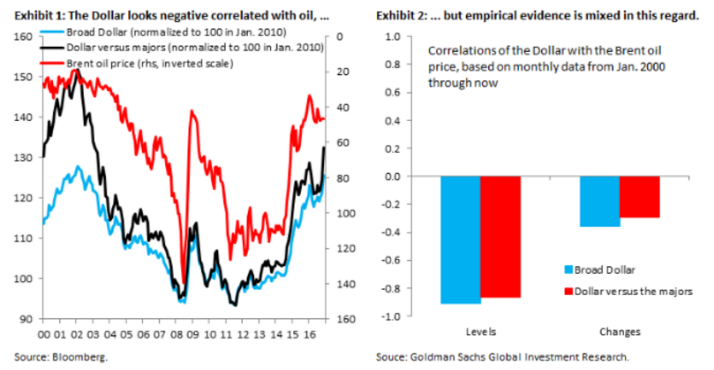

"Historically, the Dollar has been negatively correlated with oil prices, meaning low oil prices have coincided with a strong Dollar, while high oil prices have typically come when the Dollar has been weak.

We argue that the importance of this empirical relationship is overstated for two reasons.

First, many of the counterpart currencies in broad Dollar indices belong to commodity exporting countries, so that falling (rising) oil prices push down (up) their terms of trade, which weakens (strengthens) their currencies. The negative correlation thus exists almost by construction, i.e. is a bit like looking at the correlation of oil prices with their reciprocal (commodity exporters' terms of trade). In short, the correlation isn't really about the Dollar per se, but about commodity exporters.

Second, fluctuations in oil prices often coincide with other developments that have effects on the Dollar, including global demand shocks or monetary policy changes. Both of these are present in Exhibit 1, which shows the drop in oil prices during the global financial crisis, which - being a negative demand shock originating in the US - moved rate differentials against the Dollar, and the pronounced drop in oil prices in 2014, which coincided with the BoJ and ECB increasing monetary stimulus, moving rate differentials in favor of the Dollar. This is perhaps one reason why the correlation of the Dollar with oil prices is less pronounced in changes than in levels

We examine the correlation of the Dollar with oil prices using daily data, controlling for interest differentials, risk appetite and other factors. It concludes that rate differentials are the most important driver behind recent Dollar moves, followed by oil prices.

We conclude that it is primarily the forces of economic divergence that are driving recent Dollar direction, in line with our forecasts which anticipate more Dollar appreciation (around 7 percent) on these grounds".

Copyright © 2016 Goldman Sachs, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.