- Analytics

- News and Tools

- Market News

- Barclays says GBP is oversold but vulnerable to further flash crashes

Barclays says GBP is oversold but vulnerable to further flash crashes

"The key question for sterling's evolution from here is whether or not the Brexit uncertainty discount is sufficient.

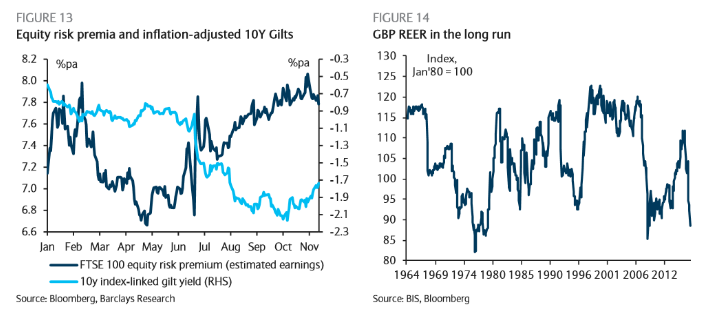

While the ultimate resolution of Brexit may have an impact on GBP's equilibrium value, at current levels, GBP represents clear long-term value, having been cheaper on a real effective basis only twice in the last half century: briefly at the depths of the Global Financial Crisis, and during its mid-70s balance of payments crisis (Figure 14).

In our view, this is more than sufficient discount, but that does not mean that GBP cannot get cheaper still.

While the medium-term value of GBP is extremely compelling, there is a strong incentive for buyers of long-term UK investments to wait for the Government to announce its Brexit negotiation plans. This leaves GBP exposed to further "flash crashes", particularly in periods of illiquidity as important constitutional questions regarding the Government's path to trigger Article 50 remain in question.

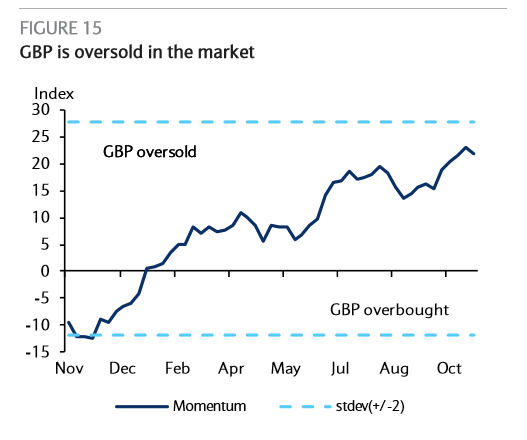

That said, positioning in GBP appears quite short and momentum indicators are indicative of oversold GBP positions (Figure 15),limiting the ability of GBP to extend significantly lower, even over short horizons".

Copyright © 2016 Barclays Capital, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.