- Analytics

- News and Tools

- Market News

- Societe Generale says its now or never for EUR/USD parity

Societe Generale says its now or never for EUR/USD parity

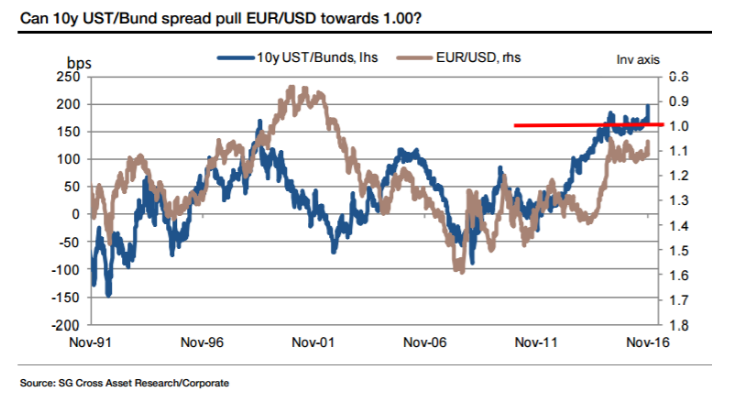

"The bullish US macro-economic 'reset' following the election success of Donald Trump has governed financial markets and sparked the bond market rout and USD buying but it is the threat of political tail risk and splintering of Europe that could decide if EUR/USD tests parity for the first time since 2002.

1. Same place, different time The election victory of Trump was the catalyst for EUR/USD to retreat below 1.06 and close in on levels only observed three times since early 2015. EUR/USD traded at a 1.0458 low shortly after the ECB launched the first purchases of government bonds in March 2015. This marked a bottom that would be followed by a rise to 1.1467 in May. The 1.05 level was revisited in the lead-up to the ECB meeting nearly a year ago on 3 December when President Draghi had signalled strong policy action. In the event, the ECB disappointed and EUR/USD shot up from a 1.0524 low to a high of 1.1376 in February.

2. Parallels with 2013 Italian election? The last leg of EUR/USD to below 1.06 coincided with the widening of 10y Italian BTP/Bund yields to just over 180bp on Friday, the highest level since May 2014. This coincided with a rise in the co-movement (Rsq) between the two variables to 0.44. This compares with an Rsq of just 0.15 for EUR/USD and the 10y US/EUR IRS spread. Closer analysis shows that 10y Italian yields became unstuck and started moving away from 1.40% towards 2.10% two weeks before the US election, but this was not picked up by EUR/USD as it rallied from 1.0880 to 1.1140 before the US election on 7 November. However, this has changed over the past week.

3. And then there is the US The timing and scale of the USD upswing caught virtually everyone by surprise. A clear out of dollar assets was anticipated on a Trump victory, but the U-turn we got instead was not pencilled in until later once the administration had laid out the specifics of its pro-growth and low-tax election agenda.

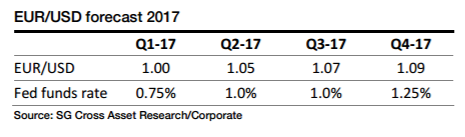

We expect EUR/USD to touch parity in 1Q 2017 before rising back to 1.09 by the end of 2017. The forecast is based on two rate increases by the Fed next year, but this comes with the risk of more. Before the election of Trump we had anticipated a peak for the Fed funds rate this cycle of 1.25%-1.50%, but we now look for 1.75%-2.0%. For the ECB, our economists believe tapering will start in March with the objective of ending asset purchases in early 2018, market conditions permitting".

Copyright © 2016 Societe Generale, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.