- Analytics

- News and Tools

- Market News

- 3 Reasons To Sell AUD/USD - Deutsche Bank

3 Reasons To Sell AUD/USD - Deutsche Bank

"A fortnight after the US election, we expect continuing weakness in the dollar bloc. While we would sell the entire bloc against the US dollar, we argue that the outlook remains most bearish for the Aussie.

First, rising US rates will likely continue to weigh on the commodity currencies, but the Aussie should suffer from the sharpest yield convergence in the next months.

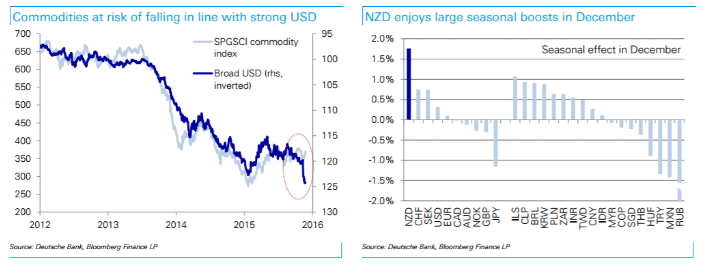

Second, in terms of trade, the broad commodity complex is at risk of snapping back into line with the strong USD (chart 1). Idiosyncratically, however, Australian miners are most imminently at risk from a bursting of the speculative bubble in base metals and bulk commodities.

Third, the Aussie faces the strongest headwinds from being the most consensus net long in G10 as well as from its extreme overvaluation, which is second only to the RMB and CHF. At the other end, CAD is best protected by sizeable net shorts and modest undervaluation. The kiwi benefits from neither but consistently sees a significant seasonal boost of almost 2% in December".

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.