- Analytics

- News and Tools

- Market News

- Whats the dollar trade? - Goldman Sachs

Whats the dollar trade? - Goldman Sachs

"In our last FX Views, we argued that the US election represents a "reset" for two reasons.

First, the possibility of meaningful fiscal stimulus in an economy where slack is close to zero raises upward pressure on inflation, as Chair Yellen and NY Fed President Dudley acknowledged this week.

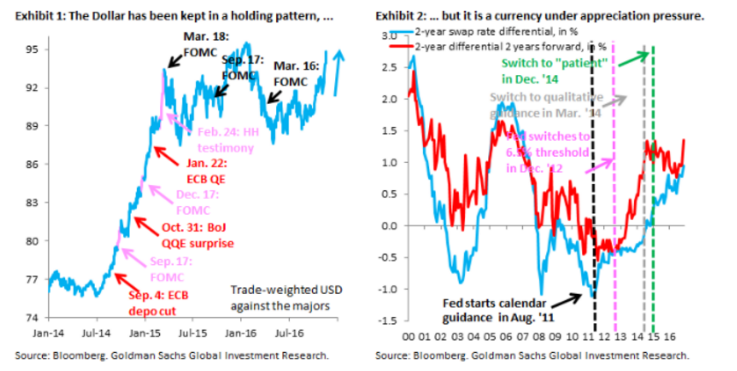

Second, President-elect Trump can make a number of appointments to the Fed in fairly short order, which could shift the reaction function hawkish. Both things have pushed front-end interest rates up (Exhibit 2), and the Dollar is now near the top of the range it has traded in since March 2015.

As in 2014, when the Dollar was on the move, the question is now how much further it can go in the near term. Federal funds futures are one lens through which to look at this. They have obviously moved a lot, but the market in our view is still catching up to the changed landscape. The market is pricing 64 bps in tightening through 2017, well below our US team's forecast of 100 bps. More importantly, through end-2019 the market is pricing 130 bps, or just over five hikes.This strikes us as low and points to further upside for the Dollar, including in the near term.

We are through our year-end targets for EUR/$ (1.08) and $/JPY (108), which were controversial just a short time ago, and the risk to our 12-month forecasts - 1.00 for EUR/$ and 115 for $/JPY - is now firmly in the direction of more Dollar strength.

Sterling downside has fallen out of favor, but we think remains one of the most actionable themes. This is why we went short Sterling and the Euro against the Dollar as one of our Top Trades for 2017.

...By choosing to also include EUR on the short leg of the trade, we are essentially taking an agnostic view with regard to EUR/GBP. Indeed, our new EUR/GBP forecast is 0.90, 0.88 and 0.88 in 3-, 6- and 12-months. The slew of elections slated to take place across Europe this year present a number of catalysts for the trade, and we have kept our call for EUR/USD parity on a 12-month horizon unchanged. Given that the ECB is so far from its inflation target, it should not respond to any rising inflationary pressures in the same way as the Fed, although premature tapering from the ECB is a risk to the trade".

Copyright © 2016 Goldman Sachs, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.