- Analytics

- News and Tools

- Market News

- USD/JPY fair value at 115.50 due to US 10’s - Danske

USD/JPY fair value at 115.50 due to US 10’s - Danske

"The election of Donald Trump as the next US President has prompted a significant increase in US inflation expectations and base metal prices driven by expectations of a significant boost to public spending, including a large infrastructure spending programme.

The US yield curve has steepened significantly as higher inflation expectations have driven an increase in yields on longer dated US government bonds. USD/JPY has historically been highly correlated with yields on 10Y US Treasuries as a widening of the rate spread tends to support portfolio investments flows out of Japan and into the US.

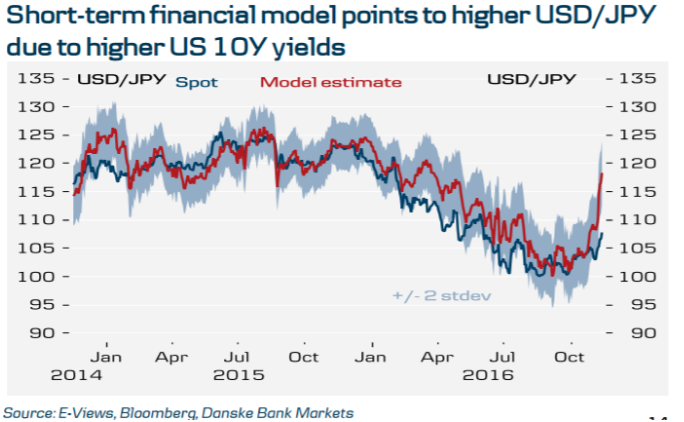

Our short-term financial model currently implies a fair value estimate of USD/JPY at 115.50 based primarily on the recent increase in the 10Y US interest rate.

Moreover, USD/JPY carry has become increasingly negative with 3M FX forwards trading at the lowest level since 2008. This has made it more expensive for Japanese investors to hedge USD assets, which might eventually start to weigh on the JPY if Japanese investors lower USD hedge ratios as long USD/JPY becomes more attractive from a carry perspective.

Hence, if the US reflation theme continues to build a case for higher US interest rates, we see a case for further portfolio investment outflows out of Japan, which in a combination with higher FX hedging costs on USD assets is likely to weigh on JPY over the medium term.

Finally, we note that higher commodity prices, in particular higher oil prices, will be a negative for the Japanese current account, which has improved substantially over the past couple of years due to the combination of previous weakening of the JPY and the oil price decline. A weakening of Japan's external balances implies less JPY appreciation pressure in the medium to long term".

Copyright © 2016 Danske, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.