- Analytics

- News and Tools

- Market News

- Nordea has a comprehensive review regarding the dollar. US productivity to play an important role

Nordea has a comprehensive review regarding the dollar. US productivity to play an important role

"While little is known about scope of Trumps future policies yet, the direction is known. Markets diverged - but not permanently. Trump is NOT Reagan, and Yellen is NOT Volcker, hence the implications for the USD and rates are different going forward...

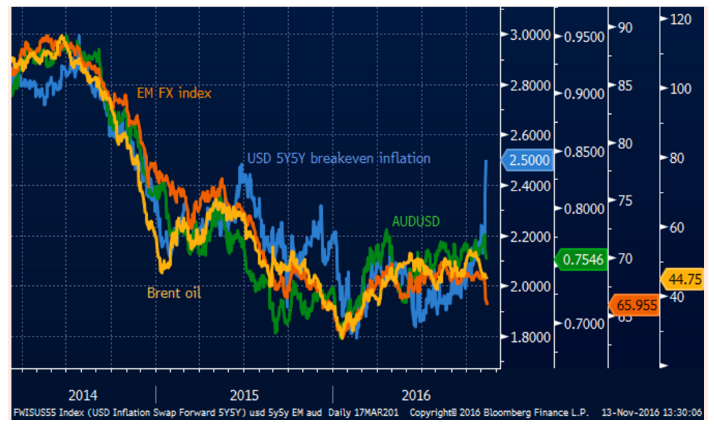

Trump managed to cause significant divergences in Markets last week: despite the base commodity prices, inflation breakevens, equity prices shooting up, the USD outperformed broadly. Will Trump make the USD great again?

While everyone focused on inflation expectations rising, the main cause of the USD strength was the rise in the USD real rates. The Market went from expecting just one Fed hike within a year to almost two hikes. The longer maturity Treasury real yields rose, e.g. the 10Y real yield came up 16bps in just a week! Hence, the broad USD strength.

But is there a justification for higher USD real yields? So far, the impression from the media has been that Trump will be another Republican Reagan who will produce an "economic miracle" by introducing supply side policies, and he will replace Yellen with Taylor or another central banker who will hike rates...maybe like Volcker did in 80s? A big myth hanging around is that Republicans in general are better for the USD ("strong USD is in the US best interests"). Well, they are not.

If there is one factor justifying higher real yields with "stronger USD and higher equity prices" is NOT which party holds presidency, but the rising US productivity. Have you seen the US productivity lately? Decade lows, and the recent capital investment patterns offer no hope for major improvement in years ahead. By contrast, during the Reagan years, and in the run-up to the dot-com bubble burst, where the US economy looked like a miracle, we indeed saw the USD stronger with rising equity prices, so a rise in real USD yields was justified. Is there a reason to believe Trump will achieve the same productivity burst again? Meh.

While little is known about exact polices, we may at least disentangle the policy shifts with Trump. Sketch a simple supply and demand framework. Depict the demand curve shifting to the right - as a realization of Trump's proposal of unfunded fiscal spending. Now, the supply side curve should shift to the right due to the proposed deregulation of financial sector, tax cuts. More growth! Not so fast.

The key difference between Reagan and Trump is that Reagan was pro-free trade and immigration. So what Trump may achieve domestically on the supply side, he may well kill with the foreign policy - anti-trade, anti-immigration measures. And given the power and realistic chances Trump has over changing the domestic supply factors quickly (killing Obamacare, Dodd-Frank…) over foreign (dismantling trade deals, imposing barriers), it does seem that the supply curve may eventually shift to the left, at least initially - i.e., less real growth, and potentially more inflation.

Will the fiscal extravagance cause the US growth miracle? Doubtful. What we may end up having with Trump is a flash-in-the-pan fiscal easing binge. But soon it will hit the wall, as will be met by circumstances, again, totally different than those of the starting point for Reagan: a larger twin deficit (need FOREIGN funding, including China), and the US public debt/GDP over three times larger. The US already got its sovereign downgrade back in 2011. Not sure Trump sees it as a way to make America great again.

Fed response? Yellen speaks on Capitol Hill this Thursday. For now, it seems Yellen will serve the full term until February 2018. Yellen is not Volcker, and it's not the roaring 80s in terms of growth and inflation. There is thus no reason for Fed to become more hawkish now. In fact, quite the opposite - domestic economic uncertainty largest since the US downgrade, and the monetary conditions have tightened after the US election, with the stronger USD and higher rates. So, if anything, more of the same in Markets will be met by Fed playing down, not up, expectations for tightening. This should be a natural killer of the market divergences we saw last week".

Copyright © 2016 Nordea, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.