- Analytics

- News and Tools

- Market News

- Deutsche Bank thinks it’s time for EUR/USD to head to parity

Deutsche Bank thinks it’s time for EUR/USD to head to parity

"We have been structurally bearish EUR/USD for a long time but scaled back our confidence levels this year as the Fed turned dovish and the ECB ran out of easing options. The Trump victory has changed things.

We now feel more confident that EUR/USD will break out of its 1.05-1.15 range and trade through parity next year.

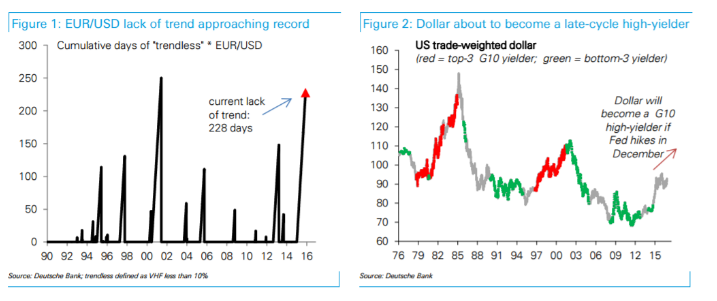

First, it is high time EURUSD started to move again. The duration of the current lack of trend is approaching a record high (chart 1). When EURUSD last broke out of such a prolonged range corporate hedgers and asset allocators were caught off guard and the EUR moved 10% within the following few weeks.

Second, the dollar is approaching its sweet spot for a late-cycle rally. Big dollar moves are less dependent on the change in short-end yields but on the absolute level: whenever the dollar becomes a top-3 G10 high-yielder it rallies as yieldseeking inflows return. A Fed rate hike this December will make the dollar the third highest yielding currency in the world, a strong dollar positive (chart 2).

Finally, divergence is back. Even before Trump, the risks to US growth were tilted to the upside (chart 3). More fiscal and regulatory easing would add further upside risk to the growth and Fed outlook. Meantime European risks are tilted to the downside given a deteriorating credit impulse and political outlook (chart 4). The recent rise in European real rates increases the odds of a more dovish ECB.

Our EUR/USD forecasts remain at 1.05 and 95 cents for end-16 and end-17 respectively".

Copyright © 2016 DB, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.