- Analytics

- News and Tools

- Market News

- USD/JPY: targets for US Elections outcomes - NAB

USD/JPY: targets for US Elections outcomes - NAB

"The near term direction in USD/JPY is at a cross road.

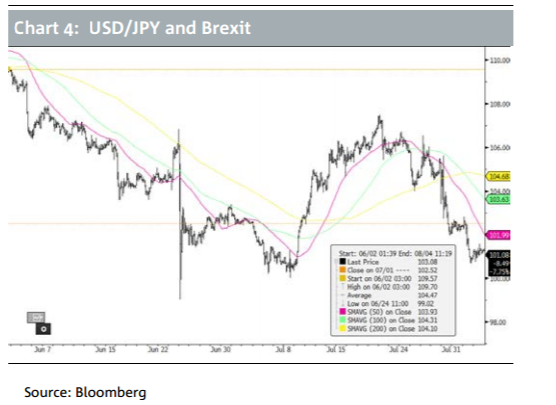

A Trump win (not our base case scenario) would put Fed hikes on the back burner and trigger a flight to safety with the JPY one of the biggest beneficiaries. This year USD/JPY has found solid support around the ¥100 mark, however under such scenario it will easily slice through this barrier. The surprise Brexit outcome saw USD/JPY trade from an intraday high of ¥106.84 to a low of ¥99.02 with the currency eventually settling 4 big figures lower relative to its previous day's close.

On a Trump victory, long term chart dynamics and recent price action suggest to us USD/JPY would likely settle around the ¥97/98 mark with an intraday low potentially a few big figures lower. Currency intervention under this scenario is also a consideration. Ahead of Brexit, Finance Minister Taro Aso warned that Japan was ready to intervene to prevent excessive yen strength, but in the event and despite the volatility and sharp currency appreciation on the day, there was no intervention. An excessive Yen appreciation will no doubt hinder Japan's already anaemic economic recovery, however unless we see a move closer to the low ¥90s, we think the MoF and BoJ will painfully sit on the sidelines.

Ten days ago - prior to the news of a fresh FBI/email probe, a Clinton win would have hauled up risk assets, sealed the deal for a December Fed hike, pushed 10y US Treasuries towards 2% and lifted USD/JPY comfortably above the ¥107 mark. With investigations into Clinton's legal affairs closed once more, then for now at least this scenario again looks conceivable".

Copyright © 2016 NAB, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.