- Analytics

- News and Tools

- Market News

- Asian session review: The markets await US elections

Asian session review: The markets await US elections

The New Zealand dollar fell slightly in anticipation of this week's meeting of the Reserve Bank of New Zealand. Economists expect interest rate cuts. Leaders of the RBNZ made it clear that interest rates will be lowered in order to overcome the low inflation expectations and weaken the national currency. However, recent data suggest economic improvement in New Zealand. Some economists predict that the reduction in rates this week will be the last in this cycle expecting key interest rate at 1.75% from 2.00%.

A key event in the next few days will be the elections in the United States. Market participants predict Hillary Clinton victory in the presidential election and is widely perceived as a positive factor for market sentiment. If she becomes president, then investors will be able to expect a rate hike by the Federal Reserve in December. Recent public opinion polls indicate a steady but slight advantage over Trump is 3-6 percentage points. Wall Street Journal / NBC News poll published on Sunday, indicate the advantage of 4 percentage points in favor on Hillary. However, in recent weeks, Trump was closing the gap, and in the last hours both candidates continue to actively conduct election campaign.

The Australian dollar fell against on the background of the widespread strengthening of the US dollar. Also, the dynamics of the Australian currency impacted by data from Australia and China. According to the report of the National Bank of Australia, the index of confidence in business circles in Australia in October fell by 2 points from 6 to 4. NAB business confidence report - a study of current business conditions in Australia. It shows the dynamics of the Australian economy as a whole in the short term. The index of business conditions in the business sector in Australia also fell by 2 points to 6.

With regard to data from China, the trade balance rose to $ 49.06 billion in October, after rising to $ 41.99 billion a month earlier, but the figure was below economists' forecast of $ 51.80. This indicator published by the Customs General Administration of China, estimates the total ratio of exports and imports of goods and services. Exports from China in October continued to fall compared with the previous year, a decrease of 7.3%, after falling by 10.0% in September. Exports declined, albeit at a slower pace, as global demand for products from the world's second largest economy was still sluggish.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1030-50 range

GBP / USD: during the Asian session, the pair was trading in the $ 1.2385-00 range

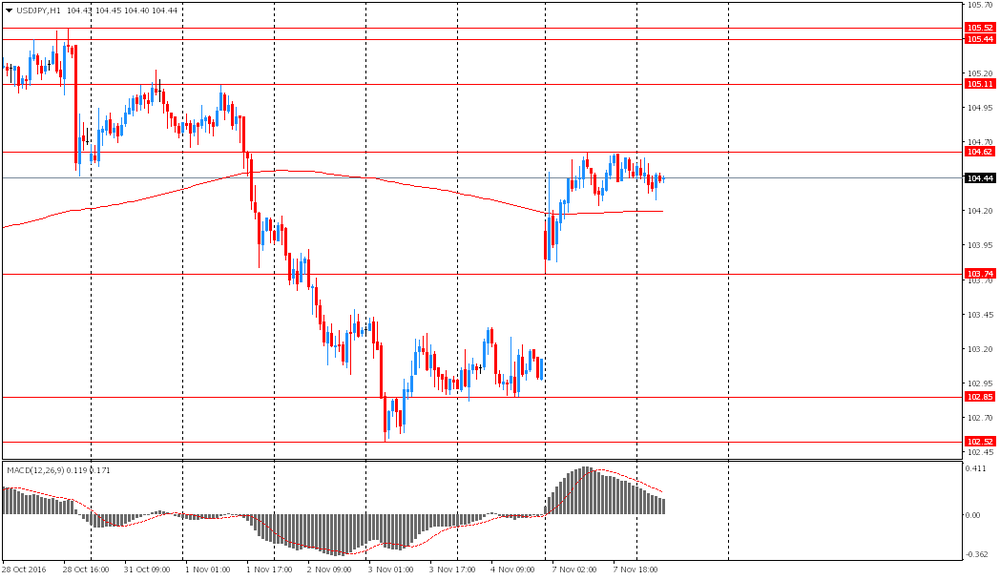

USD / JPY: during the Asian session, the pair was trading in the Y104.25-60 range

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.