- Analytics

- News and Tools

- Market News

- Wall Street. Major U.S. stock-indexes fell

Wall Street. Major U.S. stock-indexes fell

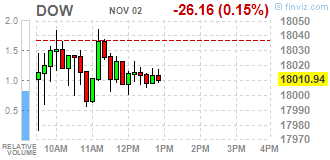

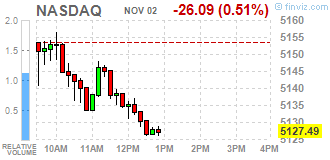

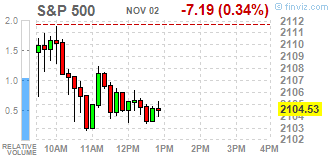

Major U.S. stock-indexes fell on Wednesday, with the S&P 500 headed for seventh day of losses as a tightening race for the White House rattled investors and a fall in oil also weighed on sentiment. Investors are rethinking their long-held bets of a November 8 victory for Democrat Hillary Clinton amid signs that her Republican rival Donald Trump could be closing the gap. While Clinton held a percentage point lead over Trump, according to a Reuters/Ipsos opinion poll released on Monday, some other polls showed her Republican rival ahead by 1-2 percentage points.

Most of Dow stocks in negative area (19 of 30). Top gainer - The Home Depot, Inc. (HD, +0.73%). Top loser - Pfizer Inc. (PFE, -1.38%).

All S&P sectors also in negative area. Top loser - Utilities (-1.3%).

At the moment:

Dow 17927.00 -12.00 -0.07%

S&P 500 2098.50 -5.25 -0.25%

Nasdaq 100 4740.50 -16.75 -0.35%

Oil 45.25 -1.42 -3.04%

Gold 1307.70 +19.70 +1.53%

U.S. 10yr 1.80 -0.02

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.