- Analytics

- News and Tools

- Market News

- Asian session review: The Australian dollar rose

Asian session review: The Australian dollar rose

The New Zealand dollar rose after strong data from China. As reported today by the Chinese Federation of Logistics and Supply, the index of business activity in the manufacturing sector was 51.2 in October, higher than the previous value of 50.4. Analysts had expected the index to rise to 50.3. This indicator reached the high of more than 2 years, suggesting signs of stabilization of the Chinese economy. Also it became known, that China's service sector business activity rose in October to 54.0 points from 53.7 in September. Significant growth was observed in investment and implementation, and the expected rate of operational activity in the sector rose to 60.6.

The Australian dollar rose after the Reserve Bank of Australia left interest rates unchanged at 1.5%. The central bank made this decision against the background of concerns about the weakness of inflation and conflicting data on the labor market, as well as overheating of the property market. The central bank said that inflation data in the third quarter as a whole was in line with expectations and will remain below the target range of 2-3% for some time. RBA called the conditions in the labor market quite ambiguous. Indicators point to continued employment growth in the short term. The pace of new home price growth is lower than in 2015. RBA also expressed concern that the global economy is growing more slowly than usual. "The pace of world output and trade growth is reduced."

The Japanese yen fell slightly after the Bank of Japan left monetary policy unchanged, confounding expectations of most observers. The Governing Council of the central bank leaves the target rate of return on 10-year government bonds at zero. The Bank of Japan also left the short-term rate on deposits of commercial banks at -0.10%. Meanwhile, the central bank moved the achievement of the inflation target of 2% later in the fiscal year 2018. The bank had previously said that it will reach the target level of inflation in the 2017 fiscal year.

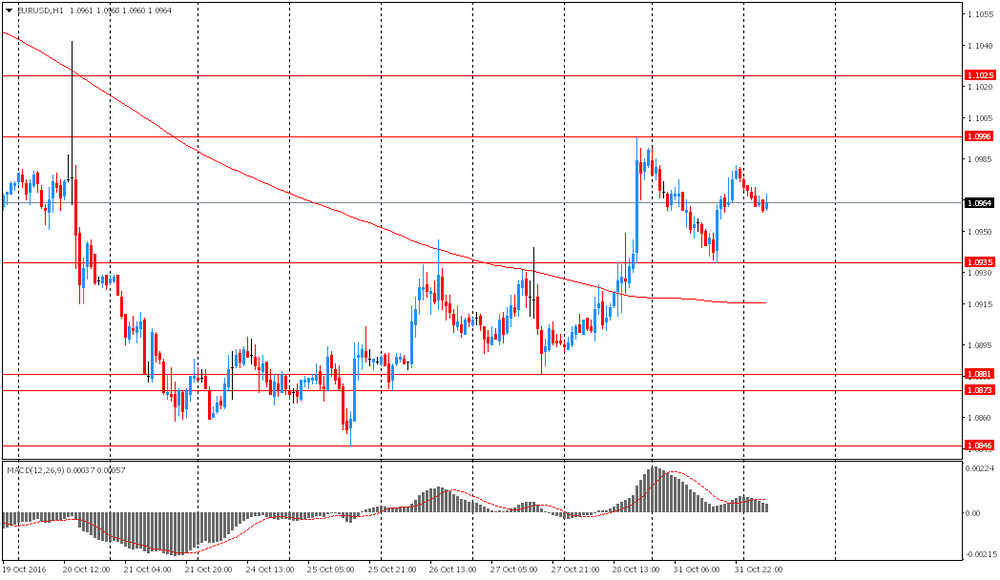

EUR / USD: during the Asian session, the pair was trading in the $ 1.0960-75 range

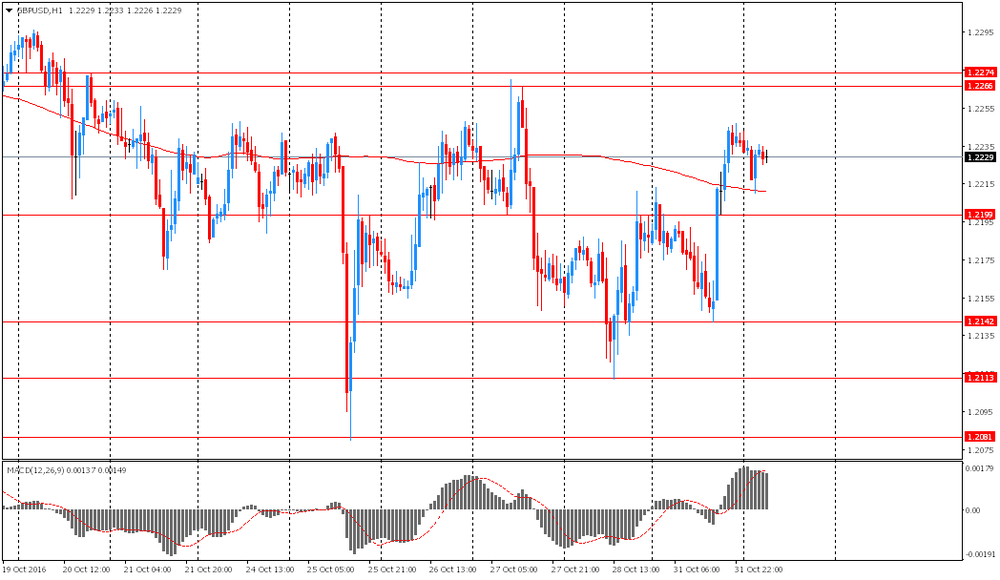

GBP / USD: during the Asian session, the pair was trading in the $ 1.2210-35 range

USD / JPY: during the Asian session, the pair was trading in the Y104.65-95 range

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.