- Analytics

- News and Tools

- Market News

- WSE: Session Results

WSE: Session Results

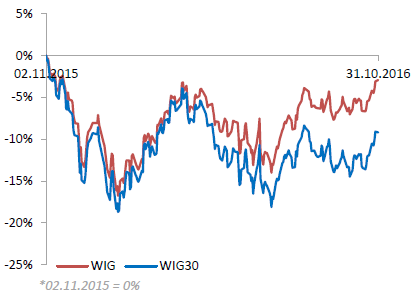

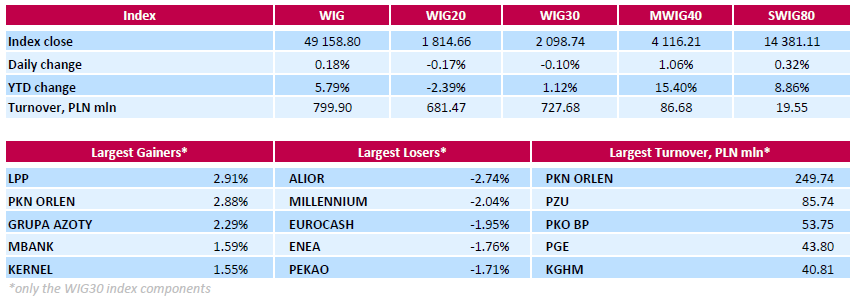

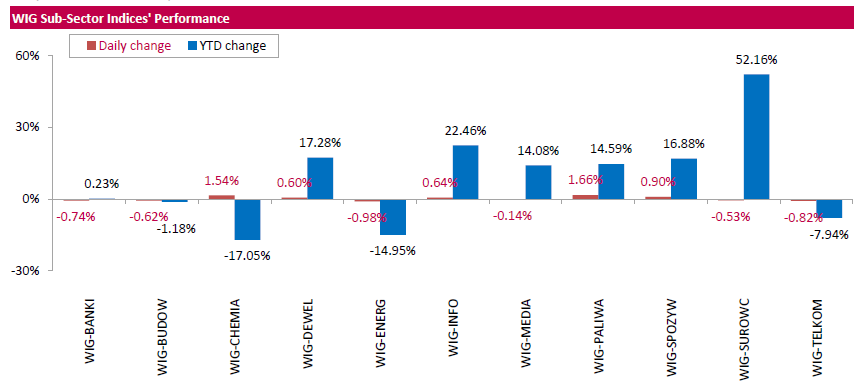

Polish equity market closed slightly higher on Monday. The broad market measure, the WIG Index, added 1.18%. Sector performance within the WIG Index was mixed. Oil and gas sector (+1.66%) outperformed, while utilities (-0.98%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, slipped 0.1%. Within the index components, clothing retailer LPP (WSE: LPP) led the gainers, jumping by 2.91%. It was followed by oil refiner PKN ORLEN (WSE: PKN), gaining 2.88%, supported by an analyst price target increase. Other major advancers were bank MBANK (WSE: MBK), agricultural producer KERNEL (WSE: KER) and two chemical producers GRUPA AZOTY (WSE: ATT) and SYNTHOS (WSE: SNS), growing between 1.5% and 2.29%. At the same time, the session's largest losers were FMCG-wholesaler EUROCASH (WSE: EUR) and two banking sector names ALIOR (WSE: ALR) and MILLENNIUM (WSE: MIL), losing between 1.95% and 2.74%. Utilities names ENEA (WSE: ENA), ENERGA (WSE: ENG) and PGE (WSE: PGE) were also beaten down heavily (the stocks tumble by 1.25%-1.76%), as the Poland's Energy Minister Krzystof Tchorzewski stated it was a mistake that country listed its state-run electric utilities, adding the main goal of these companies is providing energy security to Poland and not generating profits.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.