- Analytics

- News and Tools

- Market News

- USD Rally To Target EUR/USD At 1.05 & USD/JPY At 110 - Nomura

USD Rally To Target EUR/USD At 1.05 & USD/JPY At 110 - Nomura

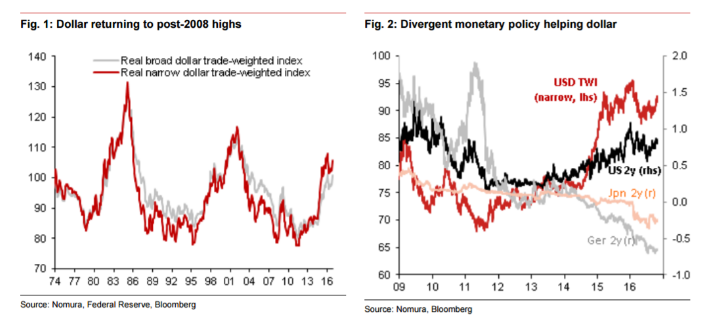

"At last, a dollar trend appears to be developing. This month, the dollar has rallied against almost all currencies including emerging market ones. The broad trade-weighted dollar is close to its post-2008 highs last seen at the turn of the year.

Undoubtedly what has helped is a monetary policy divergence story between the Fed and its peers...One factor that could further bolster the dollar would be a Clinton victory, not least because it would bring about continuity in economic arrangements between the US and the rest of the world.

As for currency pair specific dynamics, we find that euro-area investor repatriation flows, especially in equities, appear to be coming to end, while bond outflows continue. This dynamic has been a stubborn support for the euro for much of the past year, but is unlikely to be so in the future. On the yen, we expect Japanese institutions to reduce their hedge ratios as hedging costs are higher than before. There are also more signs that Japanese investors are buying foreign equities. A less-discussed factor is the decline in Chinese buying of Japanese assets, which may well have been part of a reserve rebalancing programme earlier in the year. It likely helped yen strength over that period, but as with euro repatriation, this flow will not be forthcoming.

Consequently, there is scope for dollar strength to lead to the euro heading to its 2015 lows of 1.05 and USD/JPY rising to 110 - its level before the market gave up on the Fed in June".

Copyright © 2016 Nomura, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.