- Analytics

- News and Tools

- Market News

- Whats next for EUR/USD, GBP/USD - Credit Suisse

Whats next for EUR/USD, GBP/USD - Credit Suisse

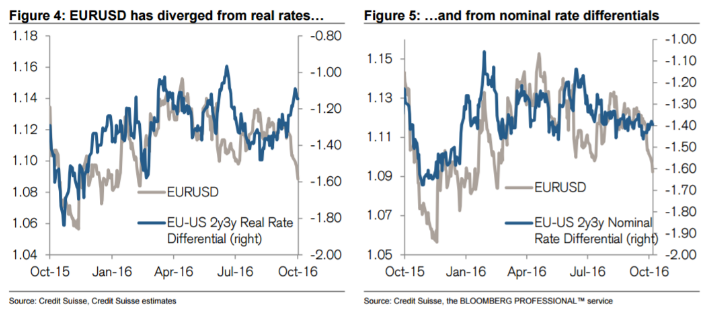

"Recent data such as Germany's Ifo survey or composite PMI data have been far from shabby. And rate differentials vs. the US have largely been stable of late. Why then has EURUSD been trending lower again? We repeat our view that we believe the political environment in Europe is a major drag on the single currency.

The UK's Brexit vote - and the subsequent GBP collapse - helped highlight the structural political and economic vulnerabilities that can hurt European currencies even when underlying economic data are still decent. In this context, the apparent failure of the EU and Canada to agree a free-trade deal due to the objections of Belgium's Wallonia region further underlines not only the profusion of political forces capable of hurting sentiment but also the timing randomness of their appearances.

Going into 2017 with multiple European elections scheduled, there seem to be numerous possibilities for political strife within countries (e.g., traditional vs radical parties in general elections) and between them too (e.g., the UK vs. EU-27 over Article 50). With ECB chief Draghi pointing out again this week that the best way to raise longer-term interest rates is to boost trend growth rates and productivity, it is hard to imagine how a trade policy mishaps and general political noise will help to create a constructive environment.

Still, at least on the monetary policy front, some near-term respite came through this week for EUR and GBP. Both currencies benefitted from comments by their respective central bank governors suggesting that monetary policymakers are not entirely unmoved by the loss of purchasing power and potential inflationary pressures weaker ultra-low rates, QE and ever-weaker currencies can bring about. After months (years?) of relative neglect of this dimension while central banks fought economic weakness and disinflationary pressure, even this modest acknowledgement may provide some near-term benefits. We would nonetheless see any consolidation in EUR or GBP vs. USD temporary and any material rally as a selling opportunity.

As technical-based trades, CS is short EUR/USD and run a limit order to sell GBP/USD".

Copyright © 2016 Credit Suisse, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.