- Analytics

- News and Tools

- Market News

- Societe Generale’s case for EUR/GBP long

Societe Generale’s case for EUR/GBP long

"How do we profit from a period of EUR/USD drifting lower in its current range as US Treasury yields edge higher, before possibly rising sharply at some point in the next six months, which is impossible to see with any precision?

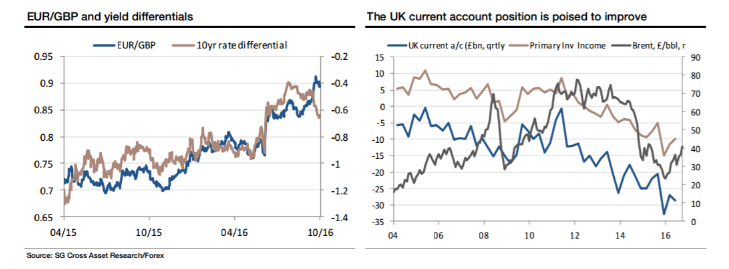

In spot, our preference is to take advantage of EUR/USD softness to buy EUR/GBP. The risk now is a broader loss of confidence in UK assets amidst political and economic uncertainty that would hurt UK bonds, currency and equities at the same time. That would send EUR/GBP up almost as much as GBP/USD fell.

Two big tail risks, for GBP down and EUR up, can make for a large move in EUR/GBP*. The danger is that now that we have seen the big adjustment in the pound, what we get from here is a tight range with low volatility, but for a directional trade, EUR/GBP looks to have a very big upward skew in the possible outcomes.

It's only fair to point out that one threat to the UK that shouldn't be overstated is the dire state of the balance of payments. Yes, the UK current account deficit is running at a quarterly rate of over £30bn, but it will soon improve. The vast bulk of the deterioration, shown in the chart below, comes from primary investment income, which mostly means the balance of income UK companies earn abroad relative to what foreign companies earn in the UK. A weak pound should help correct this, but so should higher oil and commodity prices. A strong pound and soft commodity prices really hit the overseas earnings of big UK-based resource companies, but the sterling price of oil is bouncing fast. This is worth watching, particularly when the 4Q and 1Q current account data are released next year".

SocGen maintains a long EUR/GBP position from 0.8620 in its portfolio.

Copyright © 2016 Societe Generale, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.