- Analytics

- News and Tools

- Market News

- Asian session review: little change on the majors

Asian session review: little change on the majors

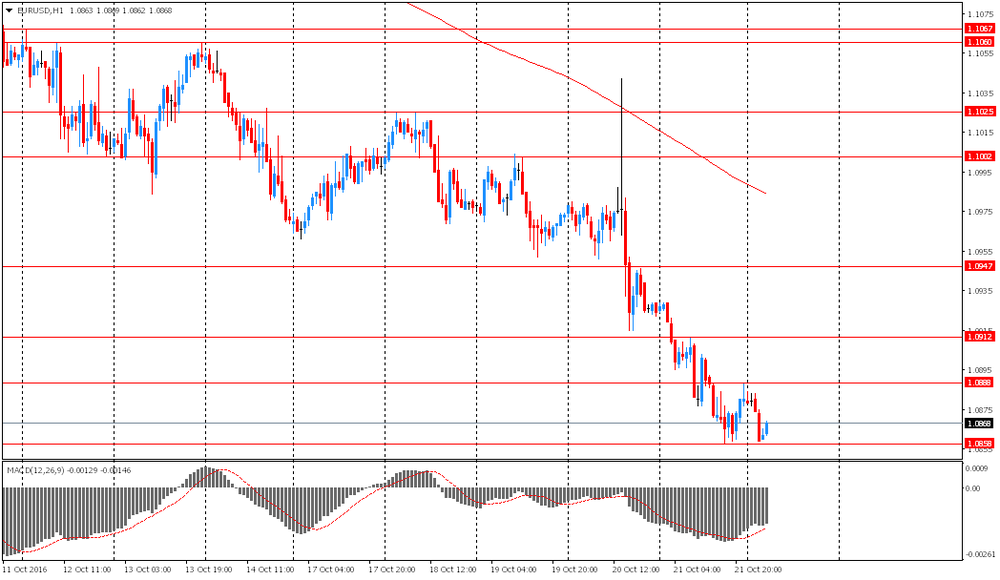

The euro extended its decline after Friday European Central Bank President Mario Draghi has hinted on the possible extension of the program of quantitative easing.

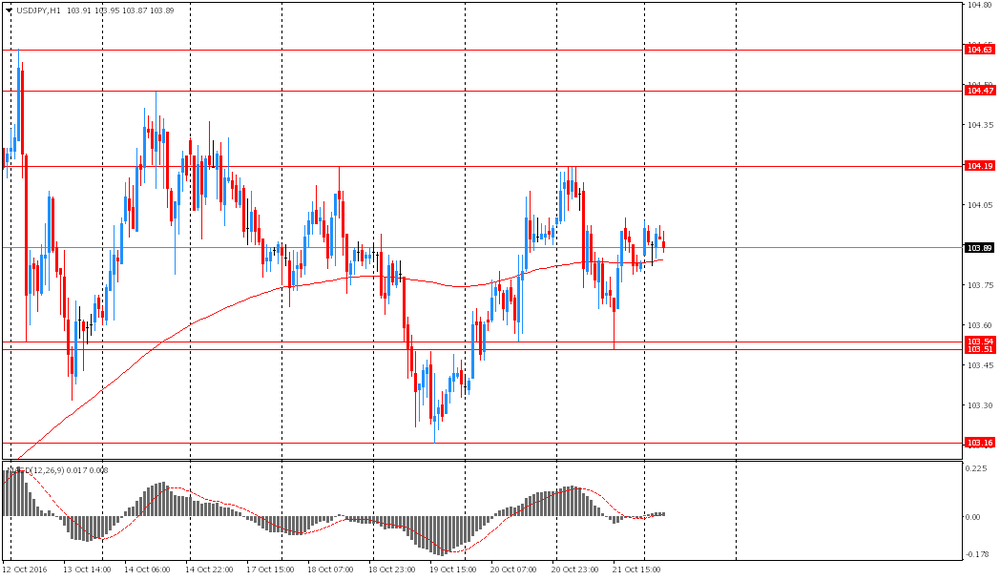

The yen traded without significant changes, despite the more positive-than-expected data on the trade balance of Japan. As reported today by Japan's Ministry of Finance, the overall trade balance in September amounted to 498.3 billion., Which is higher than the previous value of -18.7 billion and economists forecast of 341.8 billion. Annual exports of goods and services from Japan in September decreased by -6.9%, the weakest figure since March of this year.

Also positive was preliminary data on the index of business activity in the manufacturing sector Nikkei / Markit, which in October was equal to 51.1 points, higher than the previous value of 50.4.

The US dollar rose slightly against most major currencies on growing expectations about a Fed hike due to strong economic data. According to futures on interest rates from the CME, the probability of a hike in December is 70%. A month earlier it was estimated at about 50%.

EUR / USD: during the Asian session the pair fell to $ 1.0860

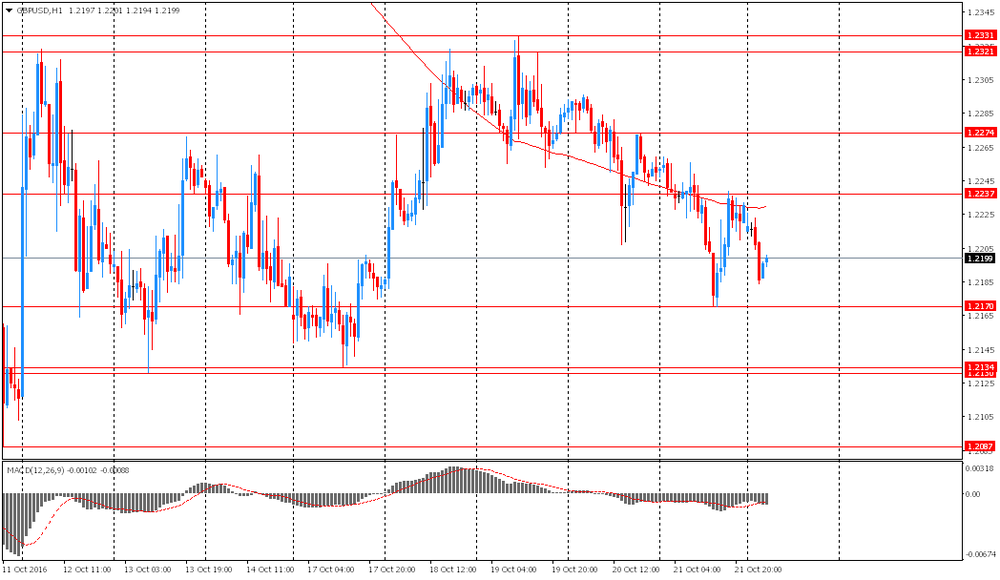

GBP / USD: during the Asian session the pair fell to $ 1.2185

USD / JPY: during the Asian session, the pair was trading in the Y103.80-00 range

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.