- Analytics

- News and Tools

- Market News

- Asian session review: The euro fell continuing yesterday's decline

Asian session review: The euro fell continuing yesterday's decline

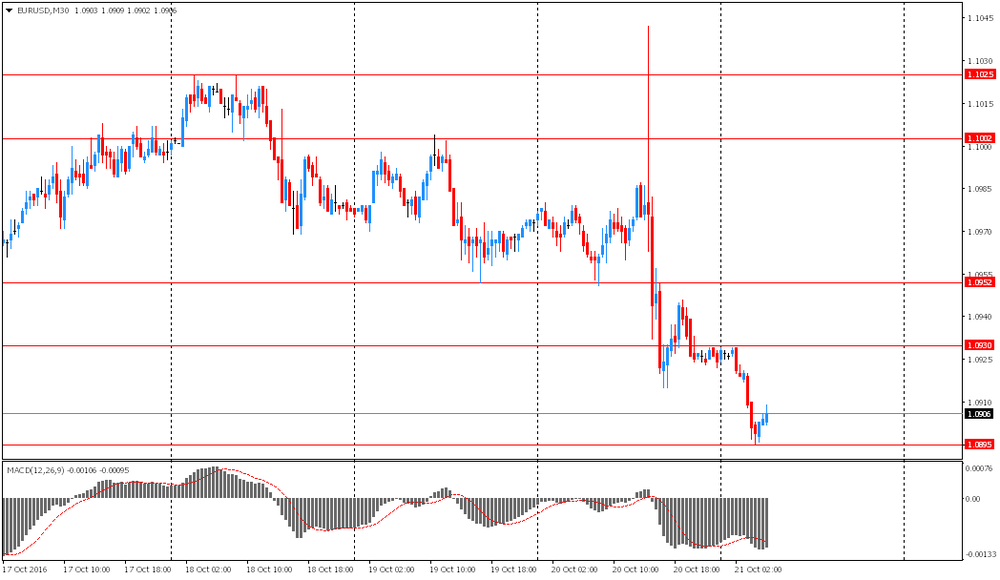

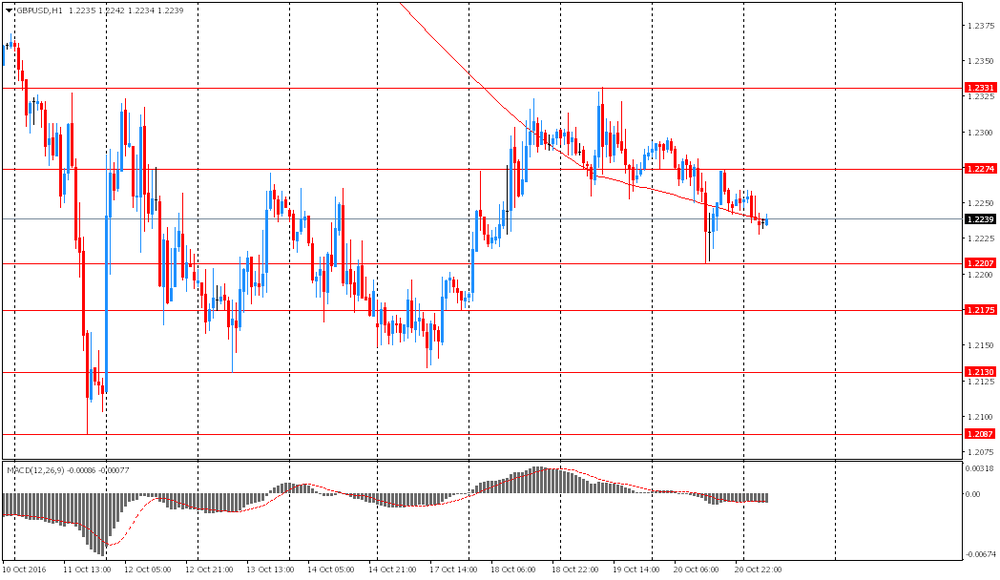

The euro fell, extending yesterday's decline after the ECB meeting. ECB left its key rate unchanged at a record low of 0%, which corresponded to the expectations. Central Bank President Mario Draghi at the press conference signaled that the bond purchase program may be continued after March 2017, but has not announced a clear intention to do so.

The US dollar rose against major currencies amid growing investor confidence in a Fed hike. According to experts, the strong economic data and comments by Fed officials support the expectations of higher interest rates in December. On Wednesday evening, William Dudley said that the central bank may be able to raise interest rates by year end. Earlier this week, the same comments made by the Vice-Chairman Stanley Fischer. According to Fed funds futures the probability of a hike in December is 74% vs 69.5% earlier this week.

Also today, Haruhiko Kuroda said that the central bank may temper the optimistic forecasts next year. This indicates a continuous struggle to complete a deflationary cycle. "We are already in the middle of the fiscal year, but inflation is still in negative territory," - said Kuroda in the Parliament when discussing consumer prices, taking into account energy. According to him, the central bank may revise its forecast that core inflation will reach 2% in 2017 fiscal year.

EUR / USD: during the Asian session the pair fell to $ 1.0895

GBP / USD: during the Asian session the pair fell to $ 1.2225

USD / JPY: during the Asian session, the pair rose to Y104.20

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.