- Analytics

- News and Tools

- Market News

- CIBC: Stay Short The Loonie Even As Oil Creeps Higher

CIBC: Stay Short The Loonie Even As Oil Creeps Higher

"If crude oil's slide was the nail in the coffin for a strong Canadian dollar, why isn't the loonie rising from the dead as oil stages a comeback? Because it's a rally for the wrong reasons, of insufficient magnitude, and its role in weakening the exchange rate has been overstated in the first place.

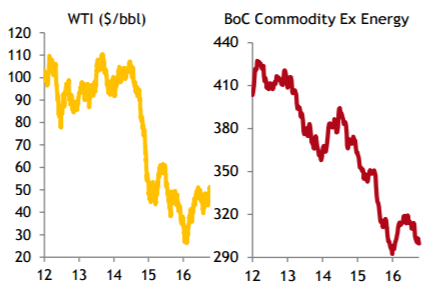

Oil's rally is a story about a pending supply cut by OPEC, not a signal of accelerating demand. Had it been a demand-pull story, we would historically have seen other cyclical commodities on the mend, but that's not generally the case. The Bank of Canada's exenergy commodity price index, weighted to the country's activity in the resource space, remains moribund (Chart). Canada's export basket does not live by oil alone, and the weakness in prices for such commodities as copper, potash and uranium, for example, are signposts that global markets aren't yet in great shape. Their softness will still be weighing on Canada's nominal trade balance, one of the drivers for the currency.

The oil rally also isn't nearly enough to get now-delayed mega-projects back on the drawing board. Rig counts in Canada have bottomed, but they're also turning higher stateside, with a US shale oil return representing a wall of supply that will keep higher cost oil sands projects off the table for a few years to come.

Oil can't bear all the blame, because even when we flirted with triple digit WTI prices in 2011-13, Canada was running a large trade and current account deficit. Instead, most of the drop in the Canadian dollar was an overdue correction from an overvalued level attained after the Bank of Canada went solo with rate hikes in 2010.

Much of what the Bank of Canada will say in the week ahead should already be priced in. Governor Poloz is unlikely to cut rates immediately, and the market should already have taken note of hints of a downgrade in the BoC's medium term growth forecast.

But if there's any reaction in the currency, it will be a modest weakening. The OIS futures market has not priced in any chance of an ease in the quarters ahead. While our base case also has a flat path for Canadian overnight rates, don't be surprised if the market prices in some chance of a cut in the months ahead. New mortgage rules should reduce the BoC's fear that a rate cut would fuel a more worrisome housing bubble, and might raise concerns of that a slowing in homebuilding will eat into growth.

Look for a dovish tone in the Bank's message to at least open the door a crack to a rate cut if necessary, a contrast to a more hawkish Fed. That's reason enough to stay short the loonie even as oil creeps higher.

CIBC targets USD/CAD ta 1.35 by the end of the year".

Copyright © 2016 CIBC, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.