- Analytics

- News and Tools

- Market News

- Asian session review: USD/JPY significantly lower

Asian session review: USD/JPY significantly lower

The New Zealand dollar rose in the second half of the trading session on positive data on consumer confidence, house prices and state budget of New Zealand. Today, New Zealand's Finance Minister Bill English shown a substantial positive balance of the state budget for the fiscal year that ended on 30 June. The surplus of the state budget was 1.8 billion New Zealand dollars against 414 million New Zealand dollars in the previous fiscal year.

Data on consumer confidence have also been positive. The consumer confidence index calculated by ANZ-Roy Morgan, in October, rose to 122.9 from 121.0 in September and peaked from mid-2015.

The US dollar lost positions previously won against the yen dropping to intraday low of Y103,55 after rising to Y104,65. Yesterday USD / JPY rose in the anticipation of the September Fed meeting minutes. At the meeting, held on 20 and 21 September, the US Federal Reserve leaders laid the groundwork for a fairly early increase in interest rates. However, the views of Fed officials are divided on the timing of the next rate hike.

Some participants considered that it would be useful in the near future to increase the target range for interest rates on federal funds, if the situation on the labor market continues to improve, as economic activity strengthens. Others would wait for a more convincing evidence that inflation moves towards the target level of the Fed, which is 2%.

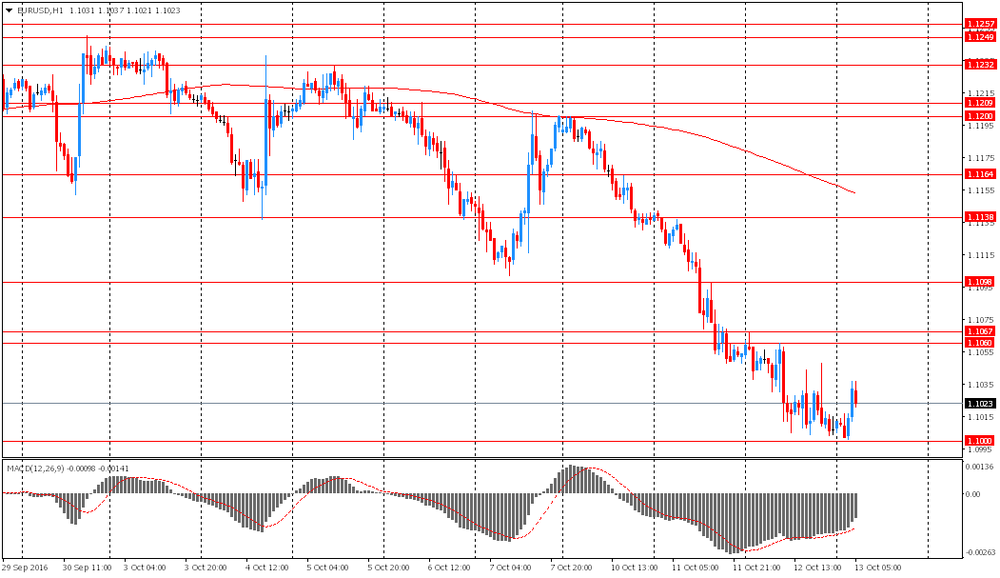

EUR / USD: during the Asian session, the pair was trading in the $ 1.1000-35 range

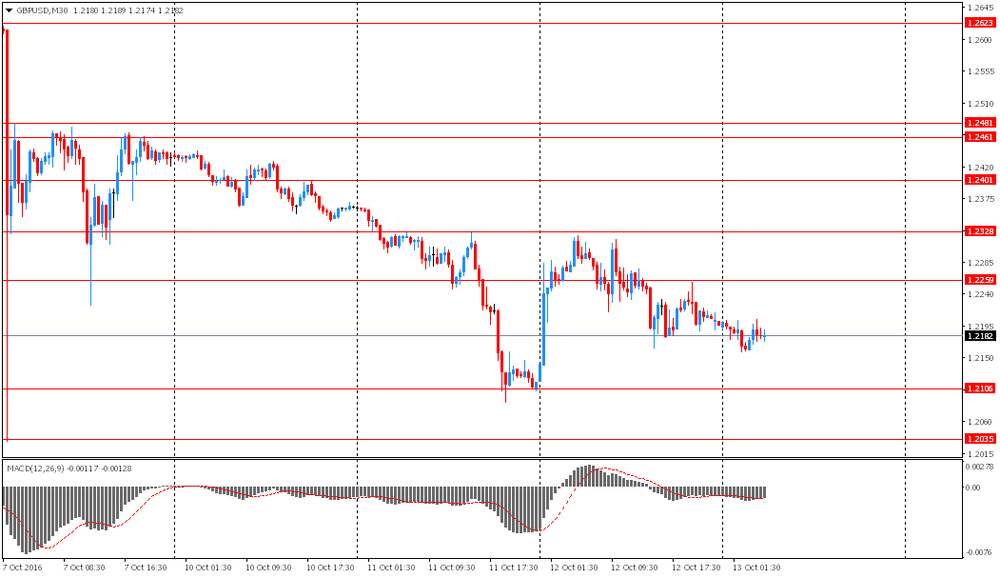

GBP / USD: during the Asian session, the pair was trading in the $ 1.2155-00 range

USD / JPY: declined 100 pips to 103.52

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.