- Analytics

- News and Tools

- Market News

- Much Better Places for Long USD Than In EUR/USD says Credit Agricole

Much Better Places for Long USD Than In EUR/USD says Credit Agricole

"FX markets appear to be shaken out of their summer lethargy by a rethinking of central bank policy mind-sets and rising long-term yields. We don't believe the September non-farm payrolls report will reverse the momentum, with the USD the ultimate beneficiary over the balance of 2016.

The BoJ and ECB are struggling with asset scarcity. We don't think ECB tapering is imminent but the Fed's experience suggests that the currency trough should not be too far away from the first verbal hint. If you want to be long USD, there are much better places than EUR/USD.

USD/JPY has turned more sensitive to relative yields than to equities, which means that the upside relies mainly on the strength of the incoming US data.

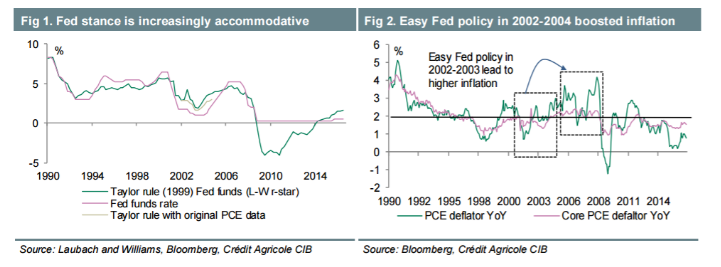

The market has spent a lot of time focusing on the implications of data for Fed policy but not enough on what policy can do to the data. Standard measures of the current policy stance, such as the Taylor rule, suggest policy is the most accommodative since 2002-2004, which should give greater confidence in some further (albeit still gradual) Fed tightening. Our US rates strategists estimate that 10Y yields are now below fair value and the curve is structurally too flat. This is echoed by expectations of a steeper German curve as well.

Vol-adjusted G10 carry is low by historical standards and higheryielding currencies are among the most expensive according to our fair-value model. Diminishing prospects of further easing in the carry funders, steeper yield curves and various political risks suggest the AUD and NZD will underperform over the coming months".

Copyright © 2016 Credit Agricole CIB, eFXnews™

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.