- Analytics

- News and Tools

- Market News

- Asian session review: NZD traded lower

Asian session review: NZD traded lower

The New Zealand dollar has fallen vs the US dollar on the backdrop of today's speech by Deputy Governor of the Reserve Bank of New Zealand, Mr. McDermott. The official noted that the quarterly inflation rate in September was likely low, to the lower boundary of the minimum target range. In addition, McDermott has suggested that further easing of the monetary policy is posible in the future, until inflation stabilized in the middle of the target range.

The yen fell despite the positive data on the balance of payments of Japan. The Current Account released by Japan's Ministry of Finance, in August was Y2000,8 bln, higher than forecast (Y1502,7 bln) and the previous value of Y1938,2 billion. The high value of the index is a positive factor for the Japanese currency. The report noted that in August, Japan's largest current account surplus in the balance of payments since 2007 has been registered. The overall rate increased due to improved foreign trade balance due to lower import prices.

Today, Charles Evans said that the Fed has made progress with employment, but the situation remains unsatisfactory with inflation. Evans said that US will probably not have reached full employment. "More underutilized production capacities observed in the labor market", - said the representative of the Federal Reserve. He also added that the natural rate of unemployment is around 4.7%, but it is likely that unemployment will reach 4.5% by 2020.

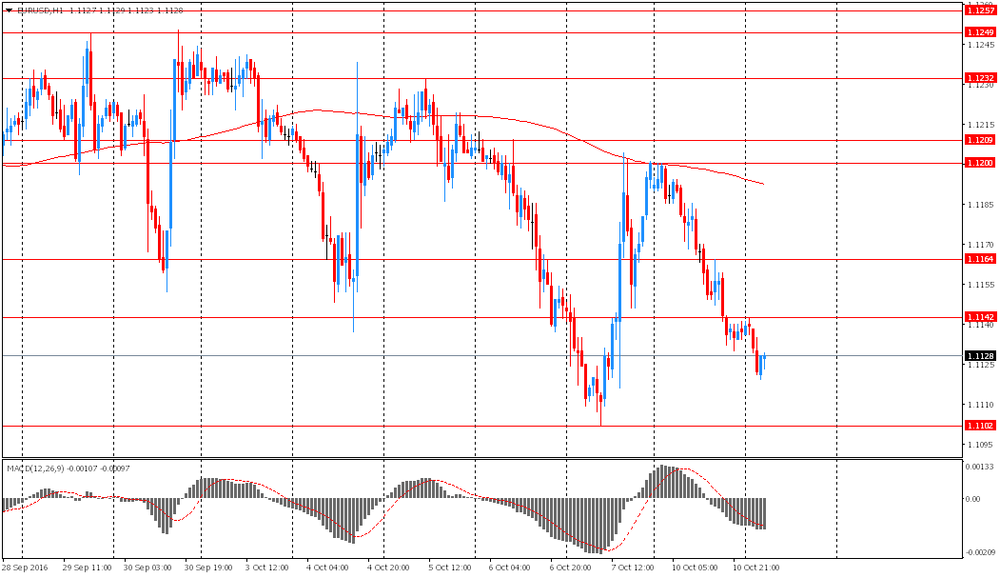

EUR / USD: during the Asian session the pair fell to $ 1.1120

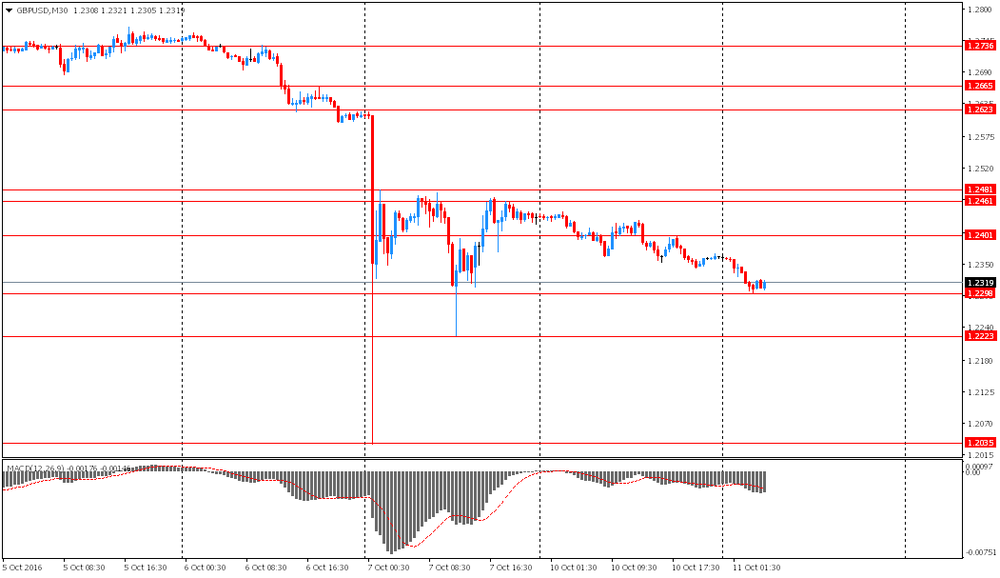

GBP / USD: during the Asian session the pair fell to $ 1.2300

USD / JPY: rose to Y104.00 in the Asian session

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.