- Analytics

- News and Tools

- Market News

- Gold trading lower

Gold trading lower

Gold fall today after stronger US data on business activity.

The US dollar rose after the manufacturing sector rebounded in September.

According to the report of the Institute for Supply Management (ISM), manufacturing PMI sector rose to 51.5 in September from 49.4 in August. Readings above 50 indicate expanding activity.

The manufacturing sector in recent years harmed the sluggish global economic growth and a strong US dollar.

"Positive news that the production index jumped after the fall, - says Brian Deyndzherfild, an analyst at RBS Securities -. Since September, the Fed signaled its intention to raise interest rates and the market, of course, will follow the economic data."

Earlier, gold prices were largely stable after the decision of the UK to triger article 50.

China's markets are closed from 1 to 9 October.

British Prime Minister Theresa May said on Sunday that the United Kingdom will start the process of exit from the EU no later than March next year, but it did not have any significant impact on the demand for gold.

Brexit calendar unlikely to have a direct impact on the gold price, says Julius Baer analyst, Carsten Menke.

Messages that Deutsche Bank is in talks with the US Justice Department to reduce the compensation designated for settlement of the dispute, also increased investors' appetite for risk.

Gold imports to India fell for the ninth straight month as weak retail demand and high prices have prompted banks and refining company to reduce foreign buying.

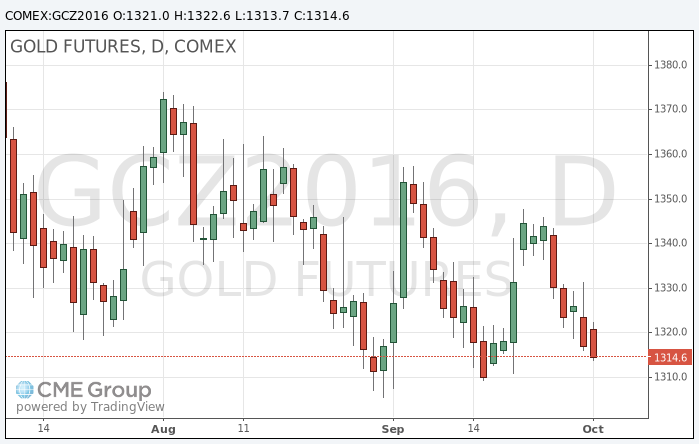

The cost of December futures for gold on the COMEX fell to $ 1313.7 per ounce.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.