- Analytics

- News and Tools

- Market News

- Asian session review: OPEC deal spice things up

Asian session review: OPEC deal spice things up

The Australian dollar rose sharply in the early Asian session on news that OPEC members agreed to limit oil production the first time in 8 years. Yesterday, the country's oil exporters said that they came to a consensus on the need to reduce the level of production. Negotiations in Algeria lasted six hours and the measures will be implemented in November. OPEC decided to create a committee that will determine how much each country is ready to cut. OPEC intends to reduce total production to 32,5-33 million barrels a day. In August, production amounted to 33.2 million barrels. Also it contributes to the growth of the Australian dollar and global stock markets.

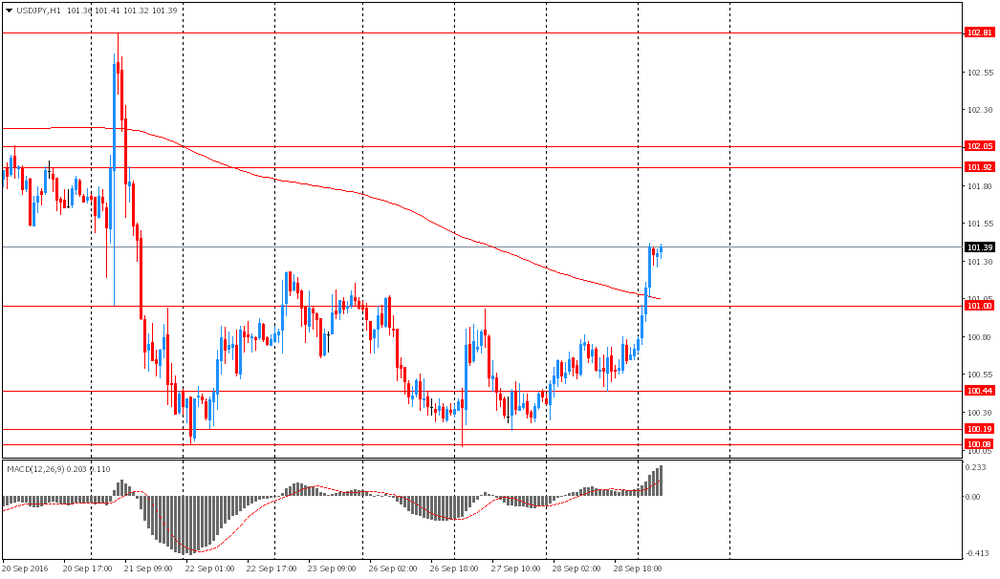

The US dollar rose against the yen, after negative data on retail sales in Japan. As reported today by the Ministry of Economy, Trade and Industry, retail sales in August fell by 1.1% after rising 1.5% in July. In annual terms, this indicator decreased by -2.1% compared to the same period of the previous year and a decrease was recorded the sixth consecutive month.

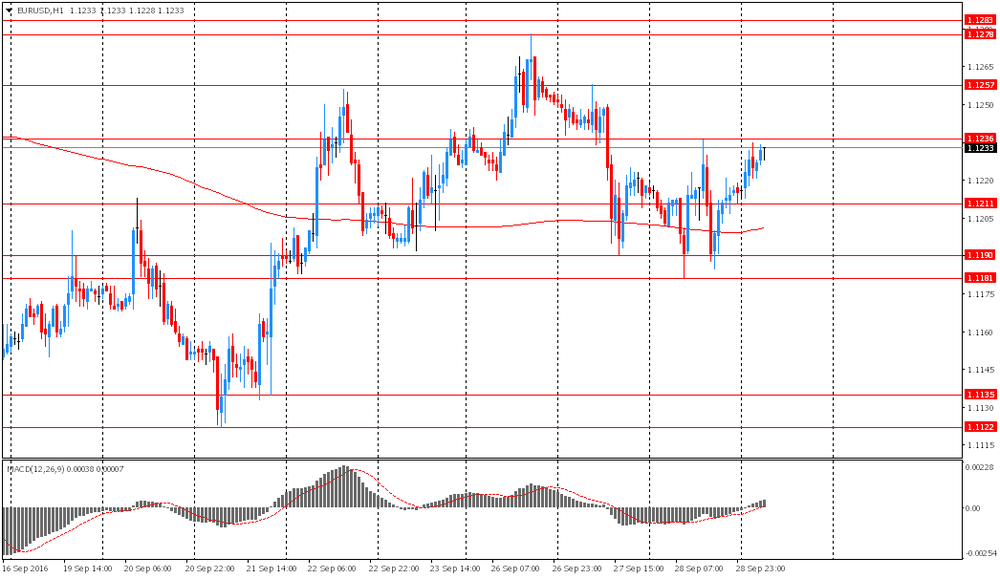

Euro slightly increased since investors continue to analyze statements by ECB President Draghi and Federal Reserve Chairman Yellen. ECB President Draghi said that the loose monetary policy of the Central Bank to prevent a new "Great Depression" in Europe. Draghi also called on the government to assist the central bank in the implementation of economic reforms. "I want to show how our monetary policy maintain price stability and counter the threat of a new" Great Depression ". According to Draghi, the ECB's measures have been effective and have helped to support the economic recovery, promoting job creation.

EUR / USD: during the Asian session, the pair rose to $ 1.1235

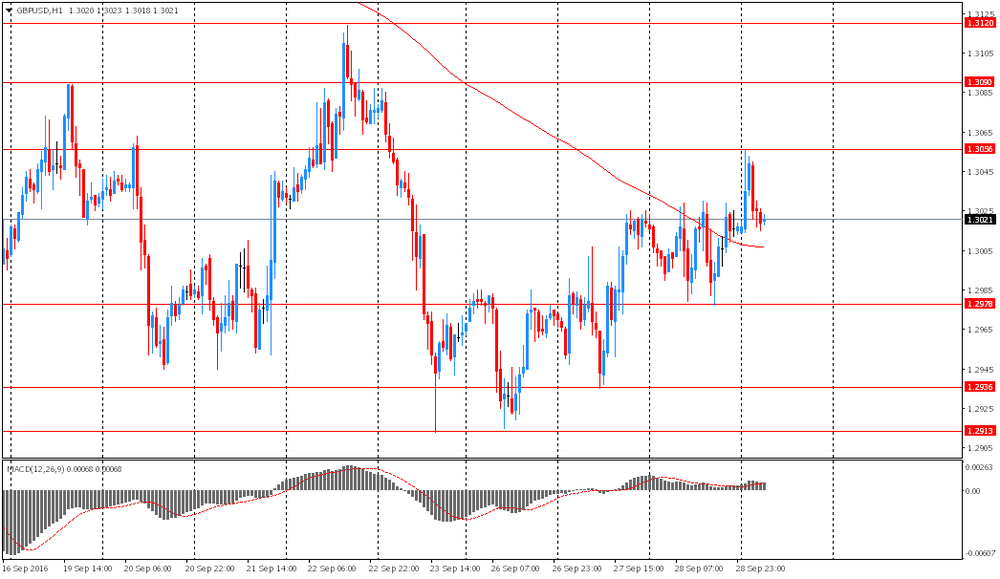

GBP / USD: during the Asian session, the pair was trading in the $ 1.3015-35 range

USD / JPY: rose to Y101.55

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.