- Analytics

- News and Tools

- Market News

- Asian session review: NZD declines

Asian session review: NZD declines

The New Zealand dollar has fallen against the US dollar as investors continue to assess the likelihood of a intrest rate change by the Reserve Bank of New Zealand in the coming months. Earlier, the Central Bank made it clear that the NZD / USD is expected to decline, and that the regulator intends to continue to lower interest rates. Most economists expect RBNZ to cut rates in November. The greatest decrease in the New Zealand Dollar was vs AUD.

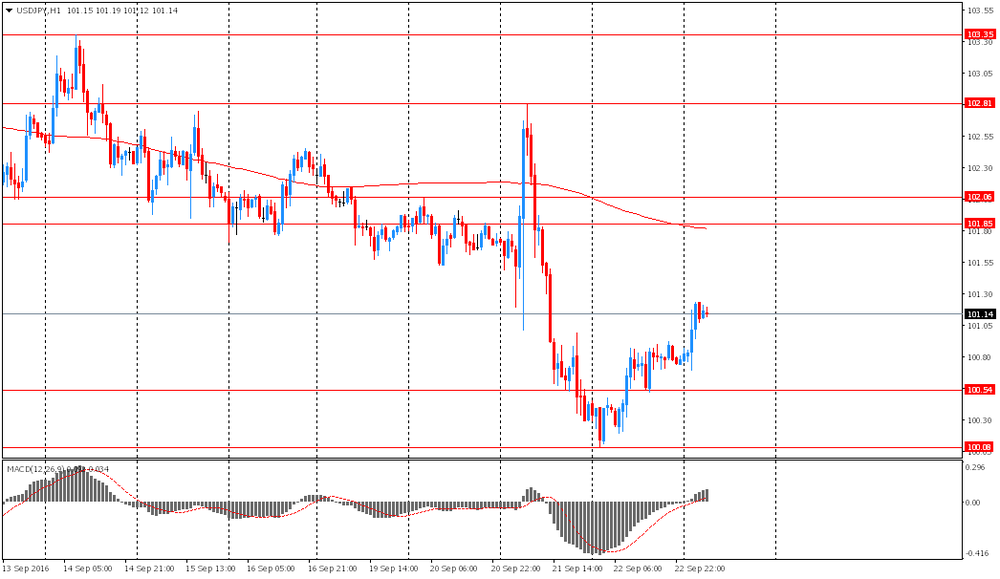

The yen fell against the dollar amid wariness of investors about the possible reaction of the Japanese government. Earlier, the yen has increased significantly on the Bank of Japan'smeeting outcome, as the central bank announced new measures by introducing the target level for the 10-year interest rates. Many investors have regarded this step as the Bank of Japan's waiver policy, which allows to control the exchange rate of the yen over the years.

Japanese data was better tha forecast. In September manufacturing PMI was 50.3 points higher than the previous value of 49.5 and economists' expectations of 49.3. Nikkei PMI provides a preliminary assessment of the health of the manufacturing sector in Japan.

Nikkei / Markit report says that the current rate of groth was the most significant in the last 7 months and is a positive sign for the Japanese production. Growth in the sector is mainly due to the increase in export orders, which previously rose to the final value of 47.2.

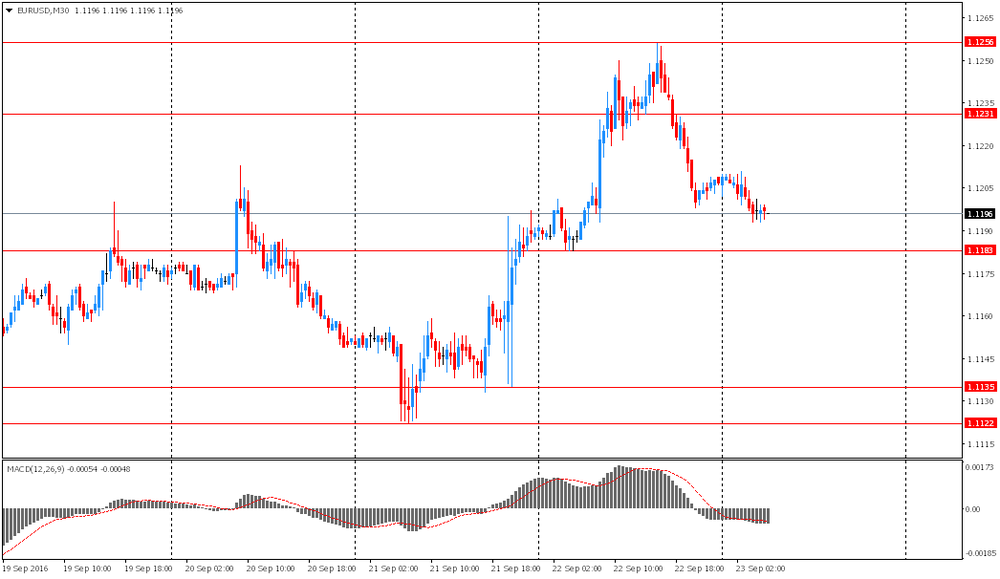

EUR / USD: during the Asian session, the pair was trading in the $ 1.1195-10 range

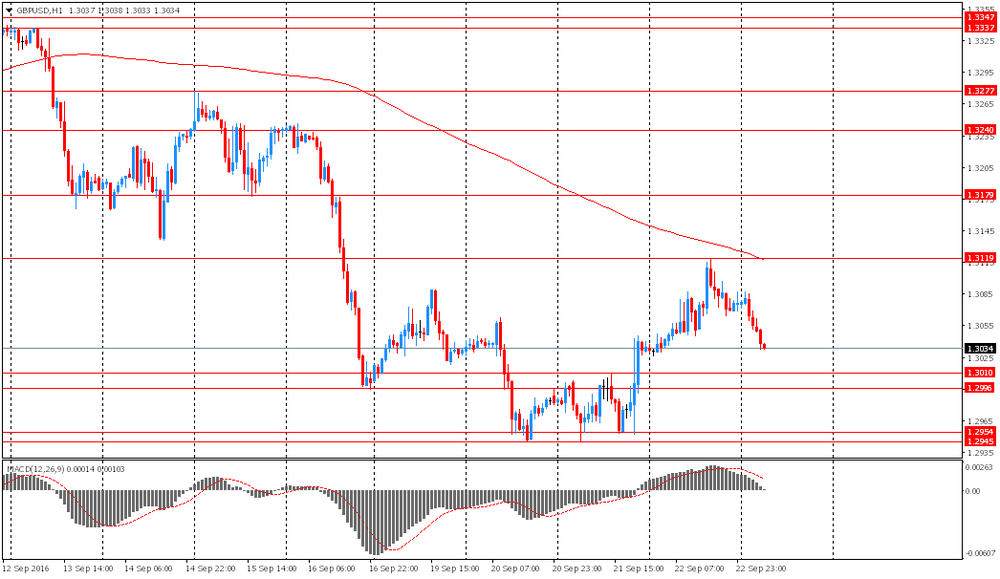

GBP / USD: during the Asian session the pair fell to $ 1.3030

USD / JPY: rose to Y101.25

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.