- Analytics

- News and Tools

- Market News

- Asian session review: The Bank of Japan took measures that even the market can’t fully understand

Asian session review: The Bank of Japan took measures that even the market can’t fully understand

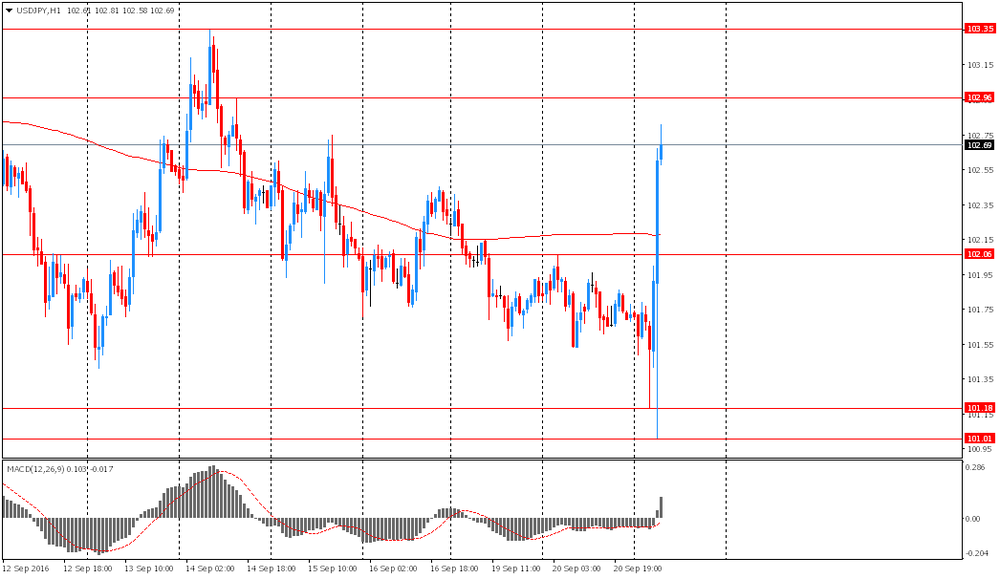

The yen has fallen by updating the session low despite the fact that BoJ did not change the intrest rate level, the regulator said that it will continue to increase monetary base, while inflation stabilizes above 2%. In addition, the Bank of Japan made a surprise move, targeting a level for the 10-year interest rates in order to strengthen the fight against deflation. This measure was adopted after the Bank management's assessment of existing measures which have not led to the achievement of inflation target of 2% for two years, as it was planned earlier. Also, traditionally the Bank of Japan announced its readiness to further reduce the negative interest rates on deposits.

Earlier today data on the trade balance of Japan was published. According to the report of the Ministry of Finance of Japan, the foreign trade deficit amounted to Y19,0 billion in August, but the forecast indicated a surplus of Y202,3 billion. In July, the trade surplus was Y513,2. Japan's exports fell by -9.6% compared to the same period of the previous year. Economists had expected a fall to -4.8%. Reduced exports continues the eleventh consecutive month. Exports to Europe decreased by 0.7% in the US to 14.5%, while in China -8.9%. Year-on-year imports fell by -17.3% compared to August of the previous year.

Today, a key event for markets will be the announcement of the Fed's decision on monetary policy. Mixed US data recently clouded the prospects of a Fed hike. Judging by the futures market, investors assess the probability of a hike at this meeting at only 18%.

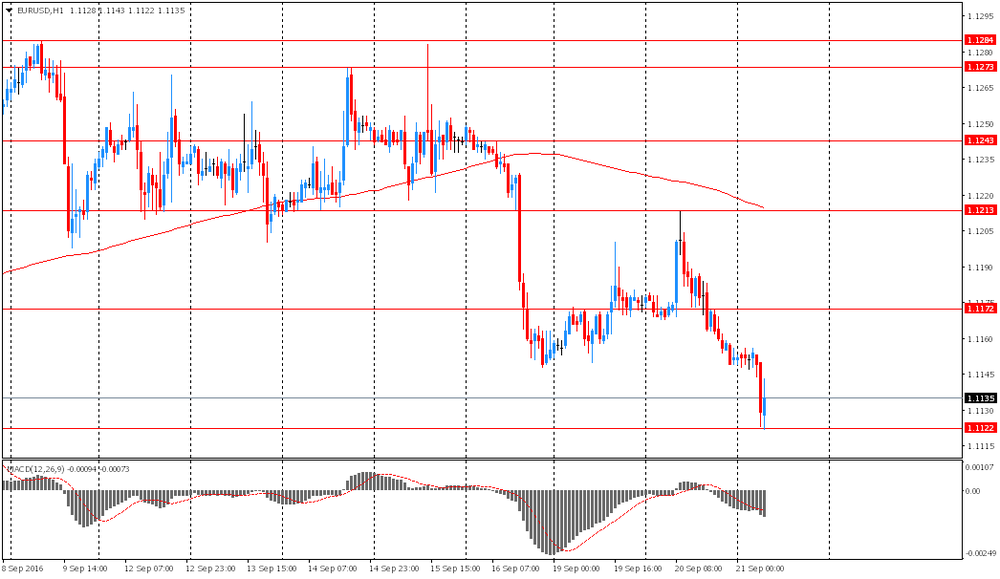

EUR / USD: during the Asian session the pair fell to $ 1.1120

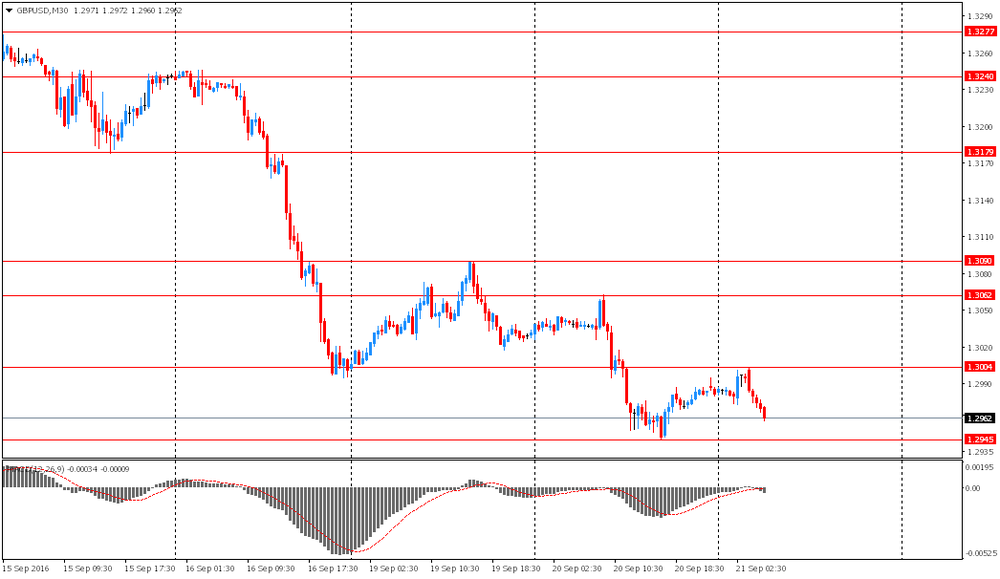

GBP / USD: during the Asian session the pair fell to $ 1.2945

USD / JPY: rose to Y102.80 in the Asian session

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.