- Analytics

- News and Tools

- Market News

- European session review: US dollar rose against major currencies

European session review: US dollar rose against major currencies

The following data was published:

(Time / country / index / period / previous value / forecast)

-----

The US dollar rose against other major currencies, but gains are limited as investors remain cautious ahead of today's US data and the Federal Reserve meeting next week.

The Commerce Department reported that retail sales in the US fell by 0.3% compared with the previous month, more than the projected decline of 0.1%. The decline was the first in five months.

Meanwhile, the Ministry of Labor said that the number of initial unemployment claims in the US rose last week, less than expected, indicating improvement in the labor market.

Labor Department also reported that the index of producer prices in the US remained unchanged in August.

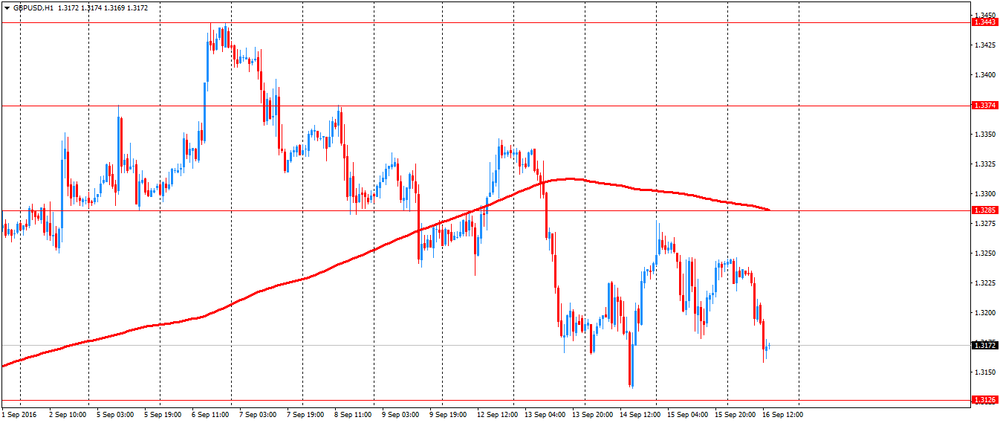

The pound fell against the dollar, while taking into account the fact that the British economic calendar for today is empty, investors will focus on the changes in risk appetite and US statistics. In addition, there may be some adjustment of positions before the weekend.

Market participants also continue to analyze the results of yesterday's meeting of the Bank of England. Recall, the Bank of England kept interest rates and quantitative easing unchanged at 0.25% and 425 billion pounds, respectively..

All nine members of the MPC voted unanimously for keeping the key rate. However, the statement was ambiguous, because the leaders of the Central Bank recognized that a number of short-term economic indicators in some ways turned out to be stronger than expected.

They also indicated that they expect at least a significant slowdown in economic growth in the second half of the year. At the same time, the Central Bank has signaled its readiness to lower the rate again if economic growth continues to slow in line with expectations.

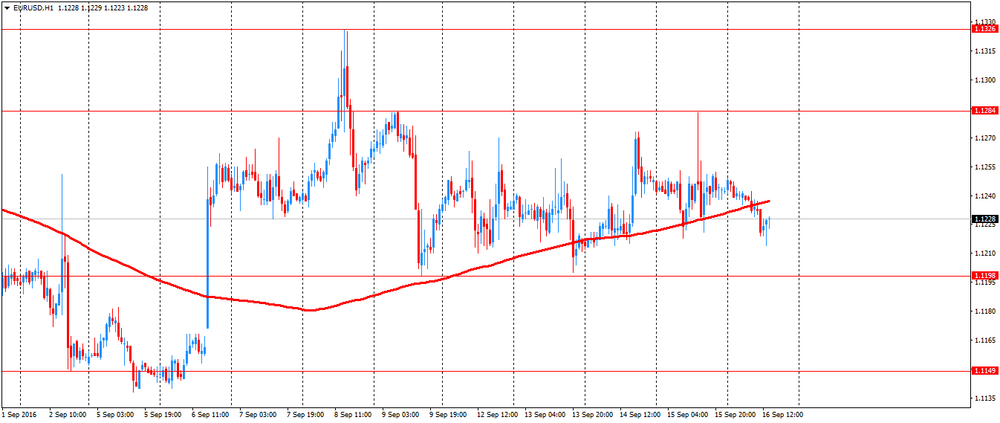

EUR / USD: during the European session, the pair fell to $ 1.1214

GBP / USD: during the European session, the pair fell to $ 1.3158

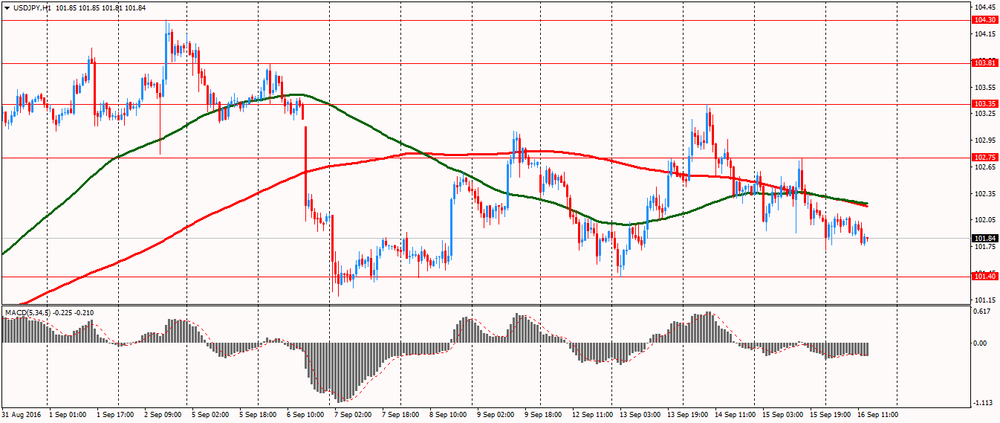

USD / JPY: during the European session, the pair is trading flat

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.